Patrick

Full time employment: Posting here.

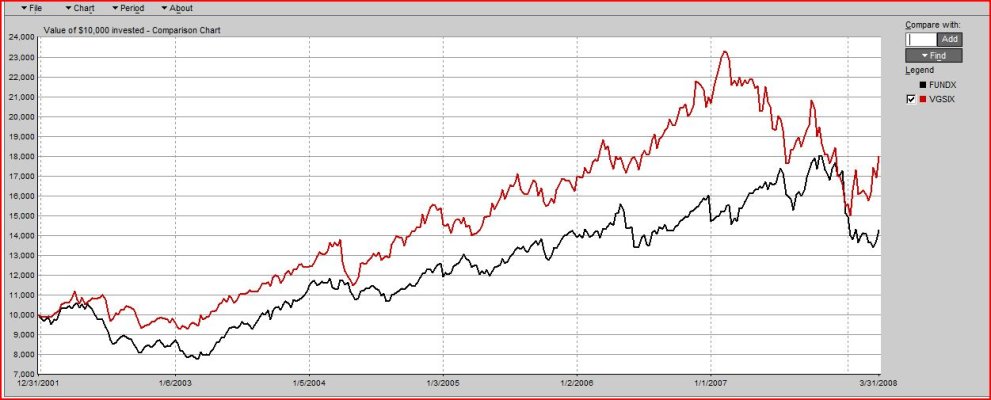

Have any of you tried the NoLoad FundX strategy? If so, how were your returns? They show that since 2000 their portfolio would have returned 103% vs. VFINX's (Vanguard's S&P 500 Index Fund) 20% (buy and hold) on a cumulative basis. That's a big difference that's worth considering.

Here's the link to their website: NoLoad FundX | Mutual Fund Perfomance | Mutual Fund Investment Strategy

Here's the link to their website: NoLoad FundX | Mutual Fund Perfomance | Mutual Fund Investment Strategy

Last edited: