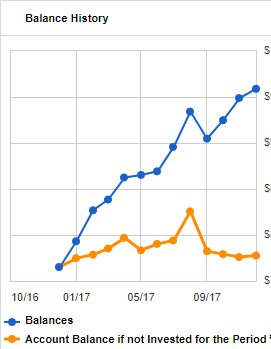

Just to give an update, I was invested in a bunch of ETFs and kept pulling in and out of the market earlier last year.

It's been over 6 months, and I've held steady with a 60/40 US/Int'l stock/bond mix in mutual funds. Getting out of ETFs cured the habit, as frequent trading is discouraged.

I now look at the market daily but avoid panic or prediction news articles about the markets. The daily swings don't phase me at all as they had before, and part of this is because I am quite comfortable with my allocation. Also, I don't have the immediacy of the ETFs, therefore there is one step removed psychologically. (This may not be the case for everyone, and ETFs may be a good fit for someone else - just speaking of my own experience here)

Anyway, just wanted to update all and thank you all here for the input you've given over the months.

It's been over 6 months, and I've held steady with a 60/40 US/Int'l stock/bond mix in mutual funds. Getting out of ETFs cured the habit, as frequent trading is discouraged.

I now look at the market daily but avoid panic or prediction news articles about the markets. The daily swings don't phase me at all as they had before, and part of this is because I am quite comfortable with my allocation. Also, I don't have the immediacy of the ETFs, therefore there is one step removed psychologically. (This may not be the case for everyone, and ETFs may be a good fit for someone else - just speaking of my own experience here)

Anyway, just wanted to update all and thank you all here for the input you've given over the months.