Thank you all who have already posted!

In the end, particularly for a newish investor, it is all about the rep, not the house. I suggest that you help her put together a list of characteristics she' like to see. Maybe a woman rep? Enough experience to have seen the markets pre-2008, etc. Then contact the branch managers, explain her needs, and ask to meet with a couple of reps that seem to suit. Maybe you go with her? Interview 'em all and then decide.

Thanks for the suggestion. Her having a rep at the local branch might be a good thing, especially in terms of confirmation. One thing I did hear from her regarding the $ I was running (from the firm who did the analysis) was that they thought it was well thought out. There was one comment about a small % GLD holding, and I explained the concept of a hedge investment.

You're a good person to help her out so much.

1) Fidelity and Schwab have checking options. Fidelity has a Cash Management Account. You don't have to open a brokerage account to get this. Schwab has a High-Yield (not really) Investor Checking tied to their regular brokerage account. It's a separate account, but you can only have it if you open up the brokerage account. Both offerings are FDIC insured, online billpay, ATM/Debit card, free checks, unlimited ATM fee reimbursements, easy electronic transfers between accounts. I have the checking options and brokerage accounts at both Fidelity and Schwab.

2) Fidelity has a VISA. You can have the 2% cash back deposited directly into either the CMA or brokerage account automatically. Schwab has an American Express. The 1.5% cash back is deposited directly into the brokerage account. I have both of these credit cards.

3) It depends on the yield she's looking for and liquidity needs. Fidelity and Schwab have brokered CD's (no commission for new issues) from 3 months up through 10 or more years. For total liquidity, MMFs that are yielding around 2% or so.

4) IIRC, I set up beneficiaries online with no trouble. PDF forms are readily available for many needs. She could also give you authority to trade or whatever suits her needs at the time.

Thanks. One of the issues I am grappling with in terms of the bucket strategy is the 2nd bucket, with a 3-5 year time frame. Some implementations put high quality corporate bonds w/known duration (i.e. individual issues) that can throw off an income stream to feed bucket 1 (Short Term/Emergency), but given the yield curve 3-5 year duration bonds aren't paying much more than CD's. So perhaps the 2nd bucket can be constructed (at least initially) with longer term (3-5 year) CD's (perhaps a latter where some mature at each year).

It appears that TDAmeritrade does have a cash management feature that may be comparable to Fidelity and Schwab:

https://www.tdameritrade.com/investment-products/cash-management.page

Further down that page is info on their VISA card, with 1.5% cash back with a 10% bonus for depositing rewards into an eligible account.

They do. I issue I had with Ameritrade is that they pay essentially nothing on cash balances and make purchases of money market funds difficult. (That is, I can find no easy way to buy/sell them, they only give a 800# to call.)

I use Ameritrade every day myself (using Trade Architect), but I have never kept cash balances of a significant amount for a significant time in my account.

"Thoughts? "

You're a nice 'ex'!

I was reading an article in the WSJ last night about Schwab and their new product offering in which for an initial fee and then a monthly fee, they would manage the 'smallish' portfolios of a customer. The comments to the article were interesting and the message was that many people were not capable or did not want to manage their portfolios - and that many were 'math-challenged.' 50% of the commenters brought up simple portfolios using ETFs or MF and Vanguard/Fidelity as well as lazy or simple portfolio AAs. In any case, I suggest that your ex is someone who is math challenged and/or just doesn't want to deal with it...perhaps she could look into Schwab and this program (I think the fees came to .25% at the most). As for her being willing to do the work herself, you will have to gauge that.

It also seems as though she is highly motivated by fear, so the bucket approach with a 3-5 year (or perhaps 10 year) horizon where the cash cushion in the first bucket may help her alleviate those fears and give her time to become comfortable with the variability in the other buckets. The cash management could become dividing the amount of the cash bucket by the timeframe and allocating the amount by the divisor (monthly?) into her checking account. Of course she should have a credit card attached to the account and based on your statement of her LCOL, she seems to have the skills to manage her spending down.

That is exactly why I also think the bucket approach might be a good way for her, mostly because of the motivated by fear aspect and the need for a healthy cash cushion. She is actually pretty good at math (at least in terms of the college courses she took), but has no real interest in the matter. She is very good at managing spending - in fact she records all of her expenses in a book over the last many years.

The next issue is ensuring the cash bucket horizon is maintained, i.e. rotating money out of the other accounts to the cash bucket.....while maintaining the AA. That to me is one of the more difficult aspect and probably the most time consuming for management as your cash position could be more complicated and time dependent (i.e. bond and/or CD ladders - getting in and out of those as they mature). The balancing on the securities could be once yearly and with many of these houses is easily done because the percentages are shown....

Beneficiary set up is easy as that is an online transaction for most, so she needs to do it once and then revisit if there is a significant change.

Roth conversions are a bit more complicated especially due to the tax ramifications - mainly what bracket you are in, what bracket you are willing to pay for the conversion and if you have enough cash on hand to cover that tax liability - although you could use part of the rollover to pay the taxes, but for some reason that is highly frowned upon (I get the reasoning regarding losing some of that in the investment, but it seems a wash to me in the end).

In sum; the cash horizon gives her time to become more comfortable doing this on her own if she wants to - otherwise, there may be a cheaper alternative through Schwab and their 'monthly' approach. Of course, you could also keep assisting her....as a super-duper really nice 'ex.'

Yes, I would have to do that on a periodic basis, and likely set up the ladders and semi-automate (or do myself) the transfers. By Schwab Monthly, are you referring to their Schwab Monthly Income Fund? I hadn't seen that before.

Regarding the management and fees:

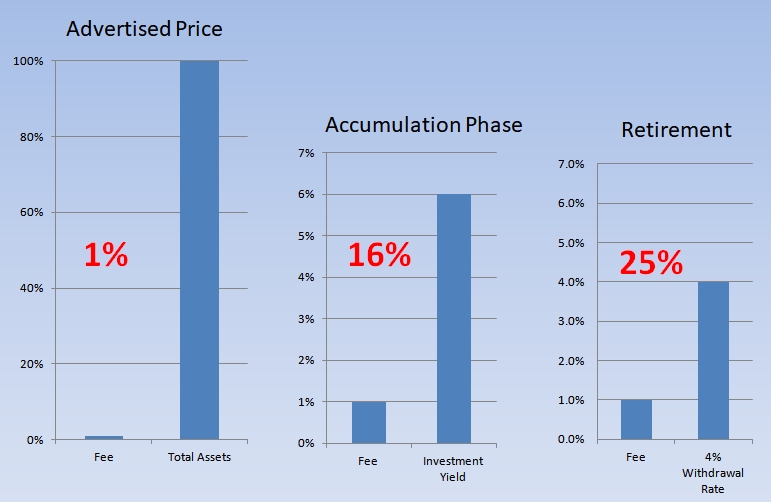

1) The fee of 1-1.5% per year might not mean much to her. But if you explain that a prudent total withdrawal rate is generally considered to be about 4%, that means the pot will pay her about $xx per year. Anything she pays the advisor must come out of that, so she'll be paying the advisor at least 25% of her annual "take." (again, maybe explain it as a dollar amount). This will happen every year.

2) Can you just find her a fee-only advisor? It will be less expensive and, more important, avoid a conflict of interest (high fee mutual funds, "special products" with commissions, annuities, etc).

3) If you become her de facto FA (esp choosing her allocation, etc), be aware that eventually somebody will come along with a sharp pencil and some slick brochures to show her (with convincing retroactive foresight) that you aren't doing as well as they could. Helping her to better understand the rationale behind passive investing is the best protection from this, and the best way to ultimately help her to do this herself OR spot a huckster if she chooses to farm it out.

Thanks. I am starting to print out a few things, for example the Buffet letter (snippets of it) where he discusses the cost of a 1% management fee. Anything anyone can point me to that illustrates this (including your great example) is appreciated.

A couple more things I forgot to mention:

1) I eventually would try to get her equity investments into a very small number of funds (for the ease of management and easy of seeing how they are doing). However some of her money (including the portion I have invested for her) is in ETF's in a non-tax-deferred account. I would not like to sell these to transfer into other positions given they have unrealized capital gains.

2) I failed to mention that she has a small Schwab Roth IRA (which might be another reason to consolidate into Schwab).

3) While I have Schwab and Fido accounts, I have never taken advantage of their check writing, debit cards, etc. (I simply ACH $ in and out.] So I appreciate the information above on those aspects.