Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

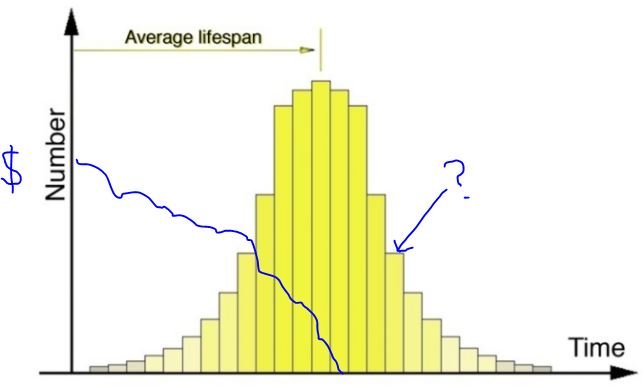

While many things get better with age, new research shows the cost of health care isn't one of them. Fidelity's Retirement Health Care Cost Estimate reveals that a couple, both aged 65 and retiring this year, can now expect to spend an estimated $245,000 on health care throughout retirement, up from $220,000 last year1.

https://www.fidelity.com/about-fide...health-care-costs-for-couples-retirement-rise

https://www.fidelity.com/about-fide...health-care-costs-for-couples-retirement-rise