Ronstar

Moderator Emeritus

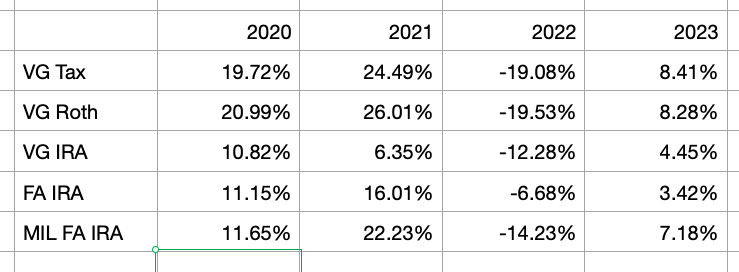

I have a Vanguard tIRA, Vanguard Roth, Vanguard taxable, and an IRA through an FA. MIL has a few accounts through a different FA.

My tIRA and taxable accounts are 100% stock. My Vanguard IRA is 58% Wellesley, 16% Total stk, 16% International stk, and 10% total bond. I realigned my mix into Wellesley in late 2001.

My FA tIRA is 5% cash, 40% equities, 45% Fixed income and preferred, and 10% alternatives.

MY MIL's FA account must be a little more aggressive that my tIRA's, in that she gains more than I do in good months and loses more in bad months.

My FA tIRA has been beating my Vanguard tIRA over the past few years - in up and down markets. MIL's account always beats my Vanguard account in up markets.

Years ago I remember my Vanguard tIRA account was beating my FA account. I'd like to get back to those times when I was beating the FA, but I'm unsure how to do it. But I need to re-allocate $ and find the best funds to serve as my non- equity portion. This without getting top heavy in equities.

What funds do you Vanguard folks use for non equity assets in your tIRA's?

My tIRA and taxable accounts are 100% stock. My Vanguard IRA is 58% Wellesley, 16% Total stk, 16% International stk, and 10% total bond. I realigned my mix into Wellesley in late 2001.

My FA tIRA is 5% cash, 40% equities, 45% Fixed income and preferred, and 10% alternatives.

MY MIL's FA account must be a little more aggressive that my tIRA's, in that she gains more than I do in good months and loses more in bad months.

My FA tIRA has been beating my Vanguard tIRA over the past few years - in up and down markets. MIL's account always beats my Vanguard account in up markets.

Years ago I remember my Vanguard tIRA account was beating my FA account. I'd like to get back to those times when I was beating the FA, but I'm unsure how to do it. But I need to re-allocate $ and find the best funds to serve as my non- equity portion. This without getting top heavy in equities.

What funds do you Vanguard folks use for non equity assets in your tIRA's?