So I thought I had some more time, but I ran open social security and it thinks my best claiming option is for my wife to claim right now and me to wait until 70. I need to understand how this relates to Fire Calc and one of us dying because it is a big difference if calculated incorrectly.

Me: 59 next month PIA $3,593

Wife: 62 and 8 months PIA $1,008

Portfolio: Fluctuating but assume $1.4M 95% taxable

Income ~ $200k, savings ~ $45k/year

Fire Calc says 100% chance of $85k income today but need $2M portfolio to get to 100% of my preferred income, which is consistent with my thinking.

I do not plan to stop work until my wife reaches Medicare due to some specific health issues and wanting to transition from insurance to Medicare with her current specialists who do not take "new" Medicare patients plus my kids being not quite 26.

I thought she would claim at her FRA and I would claim whenever I needed the money or 70 but now rethinking.

As I understand it, wife can claim now for ~ 73% of her benefit and get my FRA benefit if I die before claiming if she waits until she is FRA. That leaves her exposed to me dying between now and when she turns 67, so 4 years. 2 years are covered by my existing $1M life insurance and I need to cover 2 years somehow.

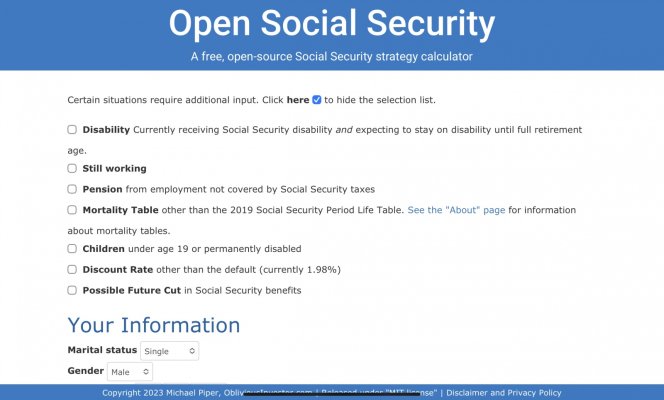

According to the opensocialsecurity.com website:

Wife claims today - we get $8,870 of which 85% is taxable. I can put most of it into her spousal IRA or into my deferred comp plan since I don't really need it to live on.

When I get to 70 I get $53,191 plus her $8,870 plus her spousal increase of $9,468 = $71,530.

If she claims today and I die tomorrow she keeps her reduced $8,870 and she can either immediately claim 73% of my $43,128 FRA as a death benefit or wait until her FRA and end up with 100% for a total benefit of $53,191.

My last question is how does Fire Calc handle this when I put in both of our SS#s and the date? I want to work on the timing but the extra $18k ($71k- $53k) per year in income will greatly increase my success rate and income, but when one of us dies we won't have it. Do people model the minimum amount or take some account of the benefit if we both live past 70?

Hopefully this makes sense, but a lot more complicated than I was thinking.

Me: 59 next month PIA $3,593

Wife: 62 and 8 months PIA $1,008

Portfolio: Fluctuating but assume $1.4M 95% taxable

Income ~ $200k, savings ~ $45k/year

Fire Calc says 100% chance of $85k income today but need $2M portfolio to get to 100% of my preferred income, which is consistent with my thinking.

I do not plan to stop work until my wife reaches Medicare due to some specific health issues and wanting to transition from insurance to Medicare with her current specialists who do not take "new" Medicare patients plus my kids being not quite 26.

I thought she would claim at her FRA and I would claim whenever I needed the money or 70 but now rethinking.

As I understand it, wife can claim now for ~ 73% of her benefit and get my FRA benefit if I die before claiming if she waits until she is FRA. That leaves her exposed to me dying between now and when she turns 67, so 4 years. 2 years are covered by my existing $1M life insurance and I need to cover 2 years somehow.

According to the opensocialsecurity.com website:

Wife claims today - we get $8,870 of which 85% is taxable. I can put most of it into her spousal IRA or into my deferred comp plan since I don't really need it to live on.

When I get to 70 I get $53,191 plus her $8,870 plus her spousal increase of $9,468 = $71,530.

If she claims today and I die tomorrow she keeps her reduced $8,870 and she can either immediately claim 73% of my $43,128 FRA as a death benefit or wait until her FRA and end up with 100% for a total benefit of $53,191.

My last question is how does Fire Calc handle this when I put in both of our SS#s and the date? I want to work on the timing but the extra $18k ($71k- $53k) per year in income will greatly increase my success rate and income, but when one of us dies we won't have it. Do people model the minimum amount or take some account of the benefit if we both live past 70?

Hopefully this makes sense, but a lot more complicated than I was thinking.