LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

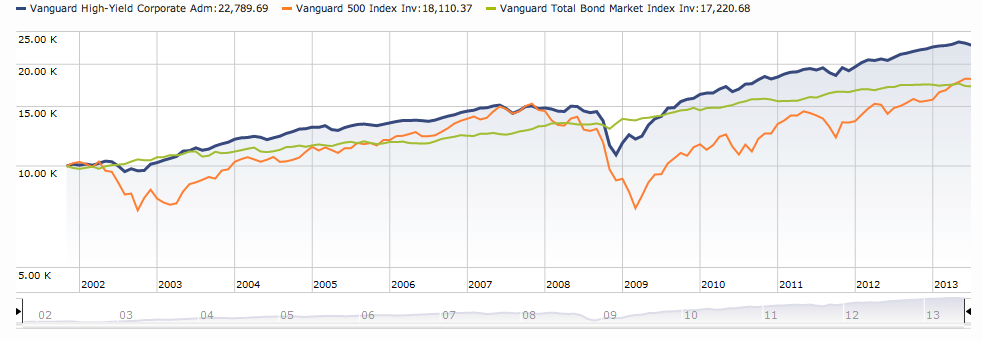

High yield bond funds are equivalent to a mix of a stock fund plus a high quality bond fund. Or are they?

How to Make Your Own High-Yield Corporate Bond Fund - Blog

I seem to recall lots of folks around here have/like high-yield bond funds. I do not own such a fund and really have no intention of owning one.

How to Make Your Own High-Yield Corporate Bond Fund - Blog

I seem to recall lots of folks around here have/like high-yield bond funds. I do not own such a fund and really have no intention of owning one.