I have the 401(k) account that I started at my former employer that I religiously contributed to since 1997 (the date I was first able to contribute) until 2017 when I left to start my own business. In 1997, I contributed $9,500.00 and got my match, then each year I made sure to increase my 401(k) contribution with part of my annual raise so I was always able to contribute the max, which was $18,000 in 2017. Since that portion of my annual raise was never in my take home paycheck, I never missed it.

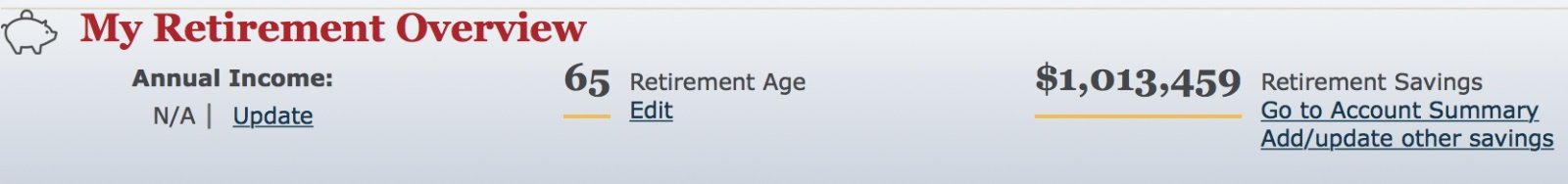

It took 23 years, but just last week the balance of that original 401(k) crossed that magic threshold.

It took 23 years, but just last week the balance of that original 401(k) crossed that magic threshold.