geoffblinks

Dryer sheet wannabe

- Joined

- Mar 11, 2016

- Messages

- 14

I would like to share my financial situation with you in hopes that you can help me evaluate and formulate a solid investment strategy.

Here are my current holdings:

I have one rental property out of state worth $315K conservatively with a $180K balance on 1st and $9K balance on HELOC.

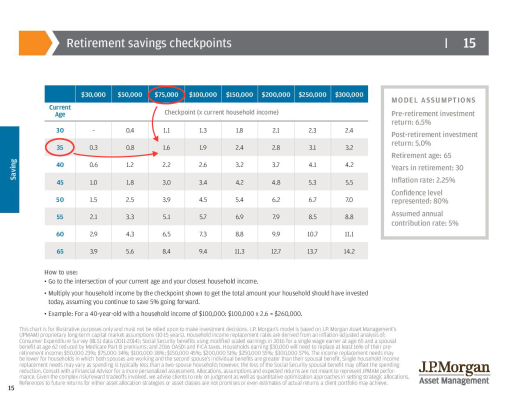

Wife and I are about 35 yrs in age. We have very little debt.

I'd like to know: Am I on track for retirement? What, if any, additional investments could I make that would be financially responsible or should I just keep saving?

Thanks!

Here are my current holdings:

- $28K in Money Market Savings

- $13K Roth IRA $10K in Wealthfront (90% stock / 10% bonds)

- $3.5K in Betterment (90% stock / 10% bonds)

- $2.5K in Acorns.com (90% stock / 10% bonds)

- $46K in Fidelity Rollover IRA - Me

- $20K in Fidelity IRA - Wife

- No debt. I make about $150-175K yr

I have one rental property out of state worth $315K conservatively with a $180K balance on 1st and $9K balance on HELOC.

Wife and I are about 35 yrs in age. We have very little debt.

I'd like to know: Am I on track for retirement? What, if any, additional investments could I make that would be financially responsible or should I just keep saving?

Thanks!

Last edited: