F.I.R.E User

Thinks s/he gets paid by the post

None of this is getting at the risk adjusted returns. If the EJ portfolio is riskier than the market, it might well have beaten it, but you may still not want to own the EJ portfolio in a downturn if it takes a bigger beating.

I think you can get useful information about risk adjusted returns by using Portfolio Visualizer with a hypothetical investment in your fund vs. others and it gives you information about risk like the Sharpe ratio, Sortino ratio, standard deviation and maximum drawdown that will give you a better feel for the risk adjusted return. I would either look up when your fund was founded and go back that far or at least try different dates in Portfolio Visualizer and let it tell you when data became available for your fund.

But even with data, how would you separate luck from skill? Maybe it was a Tech fund and this has been the era of Tech, just like past eras were dominated by coal, railroads, autos or oil. But maybe the next decades will be the era of genomics or space or nuclear or solar or robotics or even crypto and your fund could be left in the dust.

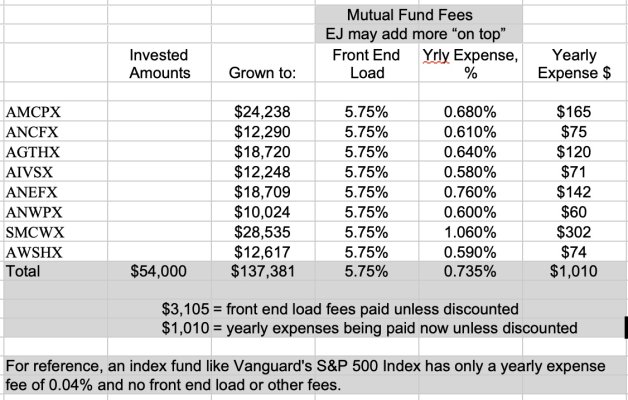

The market is an information processing machine so once something is known, it's in the price before you can blink. Since none of us get to see the future, we are equally clueless about what the market will do next. So two things matter - diversification so you get the market return and the cost to get it. I would get out of EJ and get to a low cost, broadly diversified fund, like a total stock market fund. Vanguard, Fidelity, Schwab all have low cost total market funds available.

What is wrong with a bigger beating in a down market? I benefit from DCA.

I do have just VTSAX at Vanguard for my non retirement account.