Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 414

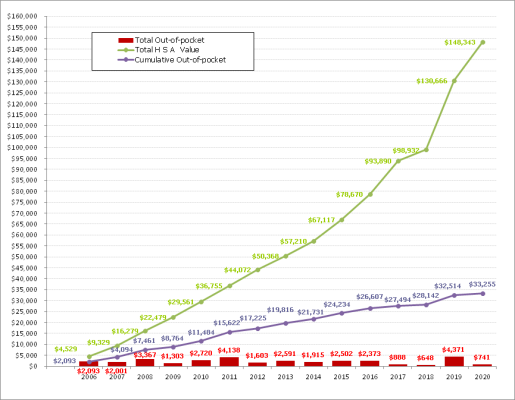

We started to contribute to HSA in 2006 - that is when HDHP+HSA was first offered to us through employer. Since then we have been maxing it out every year and never took anything out.

At the same time I have been tracking all our medical Out-of-pocket expenses that would qualify for reimbursement from HSA and keeping folders with receipts just in case.

So chart below represents how all that was shaping up for us over years - you can click on the picture to see it better.

At the same time I have been tracking all our medical Out-of-pocket expenses that would qualify for reimbursement from HSA and keeping folders with receipts just in case.

So chart below represents how all that was shaping up for us over years - you can click on the picture to see it better.

- Values for 2020 are as of today.

- We have total 4 HSAs between 2 of us - 2 at our employers where we make contributions through payroll and 2 at HSABank where we move money every year and invest.

- We did not start to invest in our HSAs till 2013 and all growth till that year was due to contributions and interest only.

- Medical expenses are for 2 adults and 1 child till end of 2016, and 2 adults only after that

Attachments

Last edited: