UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

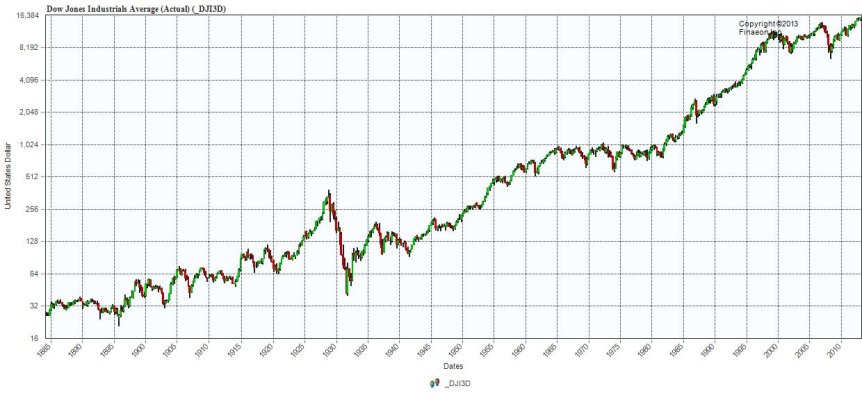

I simply accept what it is and I do not look at my statements as much. I realize that market downturns are a part of the process. I am far from a market expert . I am no expert at all. But everyone has an opinion. Mine is I would not be the least bit surprised we enter a bear market this year. Too many moving parts and none of them are good. I think the two most important that stand out to me are rising rates and a historically high price to earnings ratio. I think we go down 20% - 30% and slowly claw are way back up. No matter what I will hold tight and ride out the storm like I always have. The storm always passes eventually. This is where nerves of steel and asset allocation are so valuable. Is this how everyone else feels about it ?