I am curious ... how many folks totally manage their finances themselves ... no FA or service?

We currently have a FA (Raymond James) managing just my IRA. (~$440K).

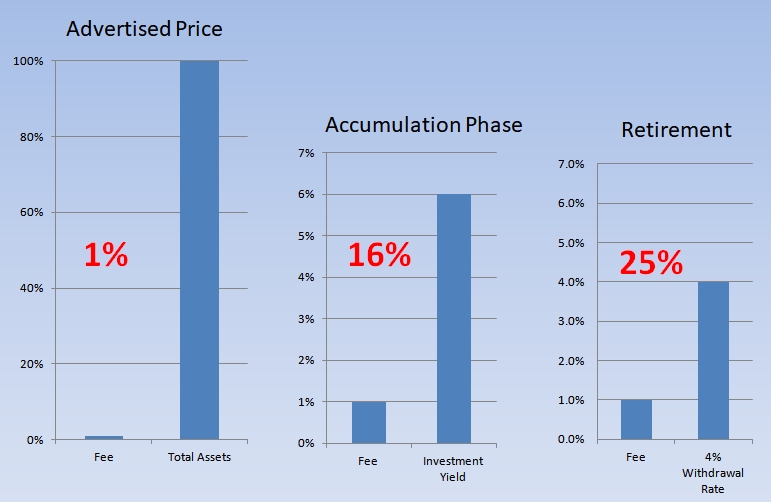

I also have a 401k and pension that I will be getting plus my wife has a 403B and pension. His fee is 1.3%. I am not excited about that and am thinking of moving everything into Vanguard index funds when I retire next year ... no FA. I would like to be a hands-off investor.

We currently have a FA (Raymond James) managing just my IRA. (~$440K).

I also have a 401k and pension that I will be getting plus my wife has a 403B and pension. His fee is 1.3%. I am not excited about that and am thinking of moving everything into Vanguard index funds when I retire next year ... no FA. I would like to be a hands-off investor.

other fees!

other fees!