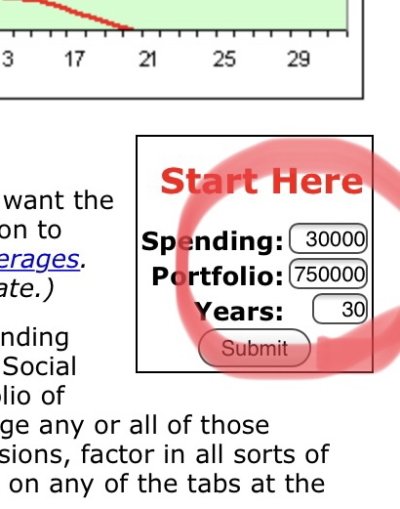

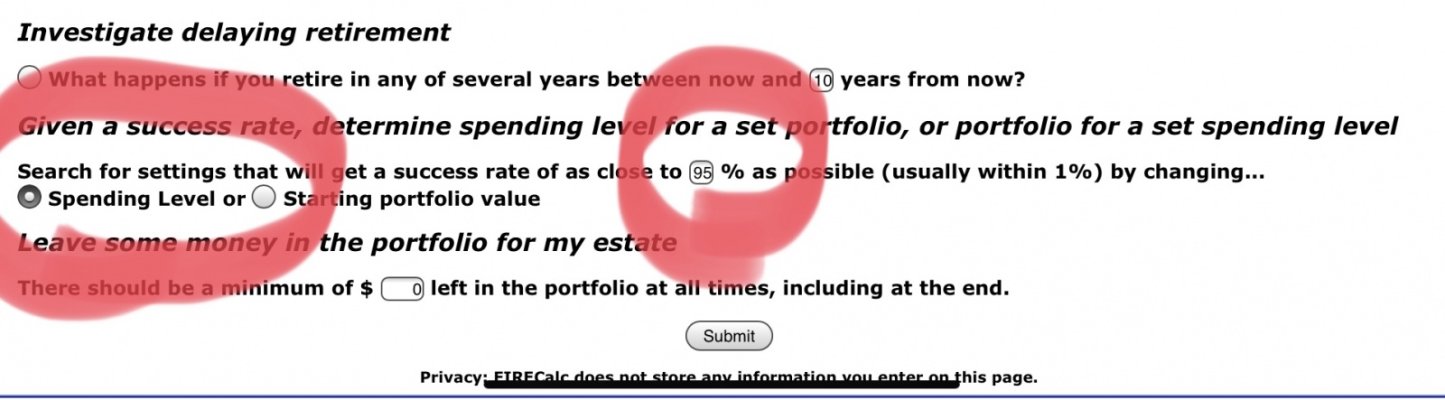

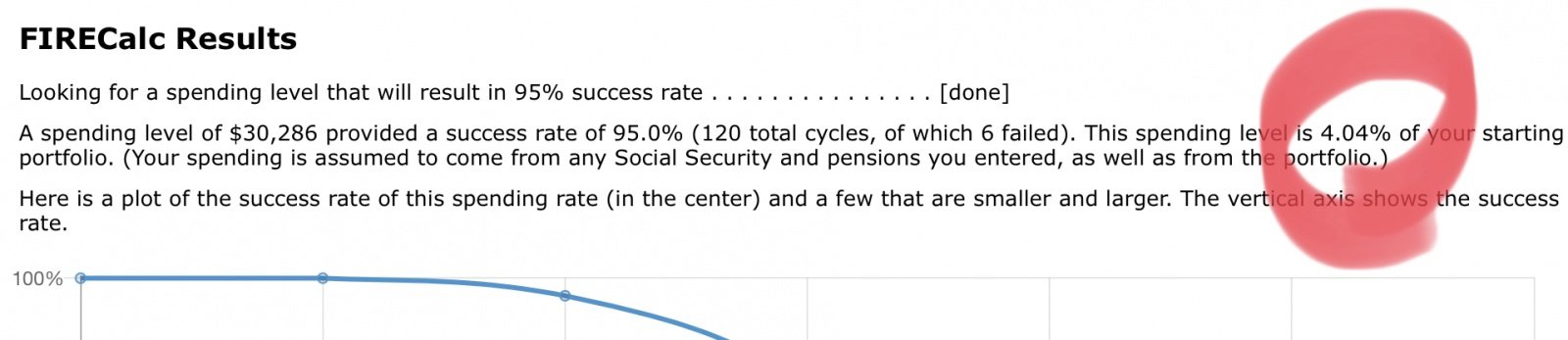

I've seen various articles suggesting a safe withdrawal rate of 3% to 4% but I presume this is on the basis you retire at 67 (or thereabouts).

How do I calculate a safe withdrawal rate for an earlier retirement. For example retiring at 50? I know the rate will reduce but not sure how to calculate what to.

Thanks in advance for any help.

How do I calculate a safe withdrawal rate for an earlier retirement. For example retiring at 50? I know the rate will reduce but not sure how to calculate what to.

Thanks in advance for any help.