easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

Okay, so 2016 is the first year I'll have my health insurance through the marketplace at Healthcare.gov.

But I'm scratching my head as to how to treat the marketplace premium payments at tax time.

I chose to not estimate my income for premium tax credits during the year. In other words, with 2016 tax filing is when I'll find out what credit, if any, I'll receive.

But back to the premium payments. My first premium was paid in the end of 2015 to start the marketplace policy for 2016. Is that, first premium counted as part premiums paid in 2015? I'd think so as that was paid in 2015 despite for a 2016 policy. Furthermore, for deduction purposes, would I use the full amount (since I have no idea what premium credit I'd get, if any until tax year 2016).

Maybe someone who has a similar situation to me (but a year prior) can share as I still scratch my head .

.

Thanks.

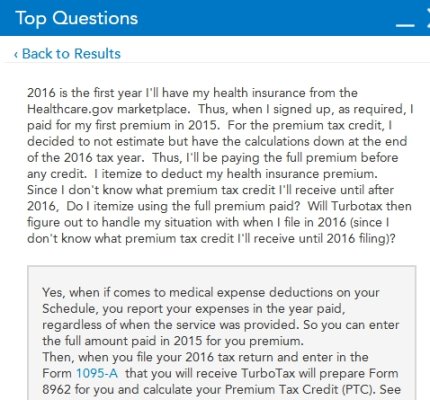

Updated: Posted a question at Turbotax Q&A area and they said to put in full amounts as deduction (1st payment for 2015 tax year), then when 2016 tax filing comes, TT will figure things out during premium credit calculation time.

But I'm scratching my head as to how to treat the marketplace premium payments at tax time.

I chose to not estimate my income for premium tax credits during the year. In other words, with 2016 tax filing is when I'll find out what credit, if any, I'll receive.

But back to the premium payments. My first premium was paid in the end of 2015 to start the marketplace policy for 2016. Is that, first premium counted as part premiums paid in 2015? I'd think so as that was paid in 2015 despite for a 2016 policy. Furthermore, for deduction purposes, would I use the full amount (since I have no idea what premium credit I'd get, if any until tax year 2016).

Maybe someone who has a similar situation to me (but a year prior) can share as I still scratch my head

.

.Thanks.

Updated: Posted a question at Turbotax Q&A area and they said to put in full amounts as deduction (1st payment for 2015 tax year), then when 2016 tax filing comes, TT will figure things out during premium credit calculation time.

Last edited: