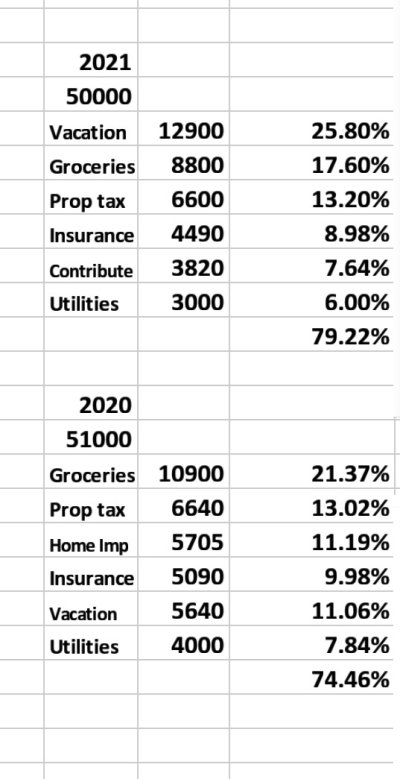

As I transition from semi-retirement to full retirement in 2022 (start some level of withdrawals), DW and I took off the governor in 2021 as an experiment to see what we might spend without any budget. Outside of the pure discretionary spending, I noticed our spend on groceries and entertainment were up around 40% & 20% to their respective budgets. How much of this was just willy nilly spending vs inflation, I am not sure? None the less, it is clear inflation was an impact in 4th quarter and does not appear to be going away anytime soon. Full disclosure, we are planning on a larger than average spend that includes a significant discretionary spend, so while controllable, it's very apparent we will need to make some adjustments in 2022 due to inflation if we want to continue like type activities in 2022. A few specific observations...

- Steakhouse filet used to be $40 now $60

- Renting the big beach house for family trip was $9K in 2021, now looking like $12K in 2022

- Other obvious ones: most groceries, appliances, cars, furniture, fuel all up due to supply chain issues and general inflation

We all have our own personal inflation based on what we spend our $$ on, but it's been a minute (late 70's/early 80's) since we have had any real inflation. How will you adjust? I suppose the easy answer is you tighten the boot straps where needed. For those of us who rely 100% on our portfolios to fund our spend, the double wammy could be a down year in the stock market along with some big inflation. I suppose like always, plan accordingly, stay flexible, and wait and see how it plays out...

- Steakhouse filet used to be $40 now $60

- Renting the big beach house for family trip was $9K in 2021, now looking like $12K in 2022

- Other obvious ones: most groceries, appliances, cars, furniture, fuel all up due to supply chain issues and general inflation

We all have our own personal inflation based on what we spend our $$ on, but it's been a minute (late 70's/early 80's) since we have had any real inflation. How will you adjust? I suppose the easy answer is you tighten the boot straps where needed. For those of us who rely 100% on our portfolios to fund our spend, the double wammy could be a down year in the stock market along with some big inflation. I suppose like always, plan accordingly, stay flexible, and wait and see how it plays out...