Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What? At 10 mins to open Dow futures down ~0.3%, S&P down ~0.6%. Cratering?

More like pockmarking

What? At 10 mins to open Dow futures down ~0.3%, S&P down ~0.6%. Cratering?

In the meantime calls for pay increases for workers to $25 an hour for most jobs actually was trending for 2 days on Twitter.

This is one of my concerns. It’s perplexing that gold isn’t going through the roof. I have a friend who is a gold bug and he’s so convinced that there’s too much money in the system that he’s going 25% gold. Not sure what he’s worth, but I’m sure he’s talking about something like 3/4 million in gold. But in the past year, gold has decreased, though the last six months its been rebounding. Still, it seems like it should be soaring and it’s not really doing that. If it’s the inflation hedge and inflation is real, shouldn’t gold have already taken off?

Maybe the gold buyers are instead buying crypto currency.Sure seems like gold should be catching a bid but it isn't.

I'm going to fill up the pole barn with copper

Poor folks who retired in '73 counting on a fixed pension or annuity were looking at surviving on a shrinking fraction of their initial purchasing power.

.

The Fed may not have many good tools to battle deflation, but it is a proven inflation killer. Just remember back to Paul Volker in ‘79. It’s painful but effective.

Here are some sobering YTD inflation stats..

Beef: + 12.40%

Poultry: +18.80%

Lean Hogs: +58.52%

Canola: +59.35%

Wheat: +19.48%

Coffee: +16.57%

Sugar: +13.49%

Corn: +57.02%

Wool: +12.64%

Lumber: +90.47% (!!) after a crazy 2020 on top of that..roughly triple 2 years ago

Milk: +21.20%

Gas: +50.03%

Heating Oil: +34.35%

...etc. More at https://tradingeconomics.com/commodity/gasoline

Pretty much, no matter WHAT any of us do with our portfolios or investing strategy, we're all pretty much in a heap of trouble with numbers like that.

And with that many moving pieces and parts, predicting an "average" future rate - or even a range - becomes darn near impossible, IMHO.

In terms of actionable to-dos..I recently bought PIMCO's Inflation Protection (Instl) fund and some IAU (Gold-backed ETF), but wish I bought more of both as they've both increased in price quite a bit since I bought and I'm now wishing I had more than I do of both. I also have little faith in US growth going forward and am pretty convinced we're going to be looking at the mother of all market meltdowns in 2021 or 2022..so am investing in International Value, US Value, China, Utilities and other areas to diversify away from US large-cap growth.

I heard a good analyst say the other day that his strategy (and one he advocates for clients) is to shift from capital growth to capital preservation given what he anticipates coming (also huge market melt-down in the near term). I personally think there's a lot to be said for that and plan to shift my own assets largely this way..

I'd speculate it will become multi-use(residential-commercial) R.E.

Most commercial R.E has certainly become unessessary after C19's work from home experiences for both employers and employees.

Where as IIRC I saw residential R.E adopt a downward slope last few yrs. from numerous sources analysis.

Good luck & Best wishes...

People will call for anything they like on social media, and others will "validate" them by re-posting.

Well as a grain farmer I can tell you that corn is coming off a 2 year cycle where it was literally selling at below the cost of production. Same story on the price of hogs. All the ag and food products mentioned are subject to huge up and down swings. I don't hear people complaining when the price goes down.

As to milk the yogurt, half and half and cottage cheese we buy haven't gone up at all in at least the last 6 months. Half and half is the exact same price I paid in March of 20.

Between 2016 and 2020 corn prices fluctuated between $3.25 and $4.50 Corn price today is $7.63 per bushel.

Milk prices are far more volitale and have fluctuated between 12 and 24 presently sitting at 19.

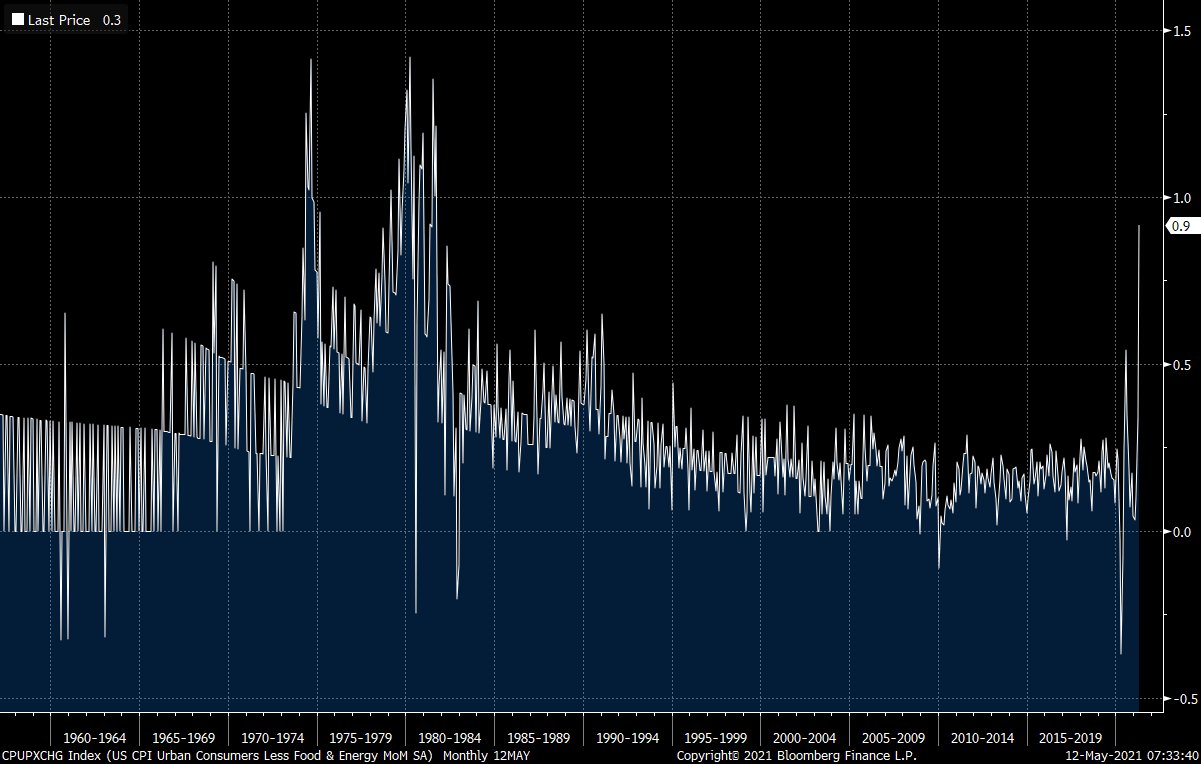

I don't think it is a complaint about the farmers as a complaint about the rapidity of the move. Commodities have been as you probably know in a 20 year downtrend and at the start of the year reversed that trend and it is now exploding out, the AVERAGE commodity over the past year as measured by the Bloomberg Commodity index is up 53% as of today.

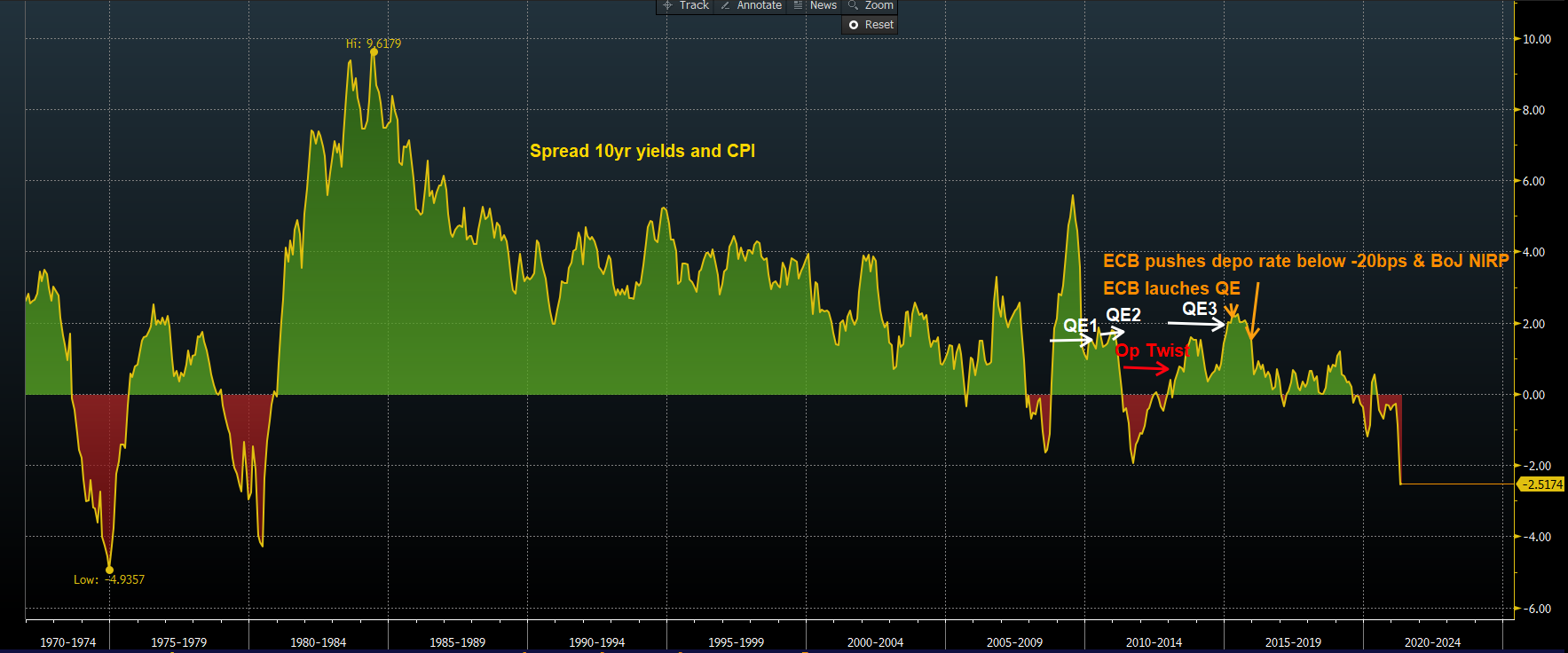

The sustained trend of this raw material input is just now only beginning to hit the end stage of consumer prices. The FED has no appettite to slow this and risk the economy, they will not move unless inflation is really out of hand, which of course is too late, but they are willing to take that risk because of the 2007-2010 FED experience and the taper tantrum.

Since there has been almost no serious inflation for most adults in their lifetime (54% of the US population was born after 1980 and about 70% will start their adult working life after 1980) and so have only known inflation to be less and less of a threat, something you read about occassionaly on your phone in your facebook newsfeed, but nothing you ever witnessed.

I don't think it is a complaint about the farmers as a complaint about the rapidity of the move. Commodities have been as you probably know in a 20 year downtrend and at the start of the year reversed that trend and it is now exploding out, the AVERAGE commodity over the past year as measured by the Bloomberg Commodity index is up 53% as of today.

I like the inflation of my home value, approximately 8-10% last year and the same predicted again for this year. And that growth is on the whole home value, not just the half I have in equity. Leverage, Baby.

Sadly, while my assessed value keeps going up, and my property taxes and homeowner's insurance have doubled over the last 18 years, with homeowner's insurance going up over 12% this year alone, my home's true market value is about same as what it was when I bought it 18 years ago - this just isn't a good area for home values, hasn't been for years, and it seems to be getting worse, but that doesn't prevent the taxes and insurance from skyrocketing. It's the worst because it makes me feel more stuck here knowing how little I'll have to sell my house for vs. buying a very similar one about anywhere else I would rather live. They say it's a buyer's market.I like the inflation of my home value, approximately 8-10% last year and the same predicted again for this year. And that growth is on the whole home value, not just the half I have in equity. Leverage, Baby.

We buy 500lbs of deer corn each month. (DW likes to feed the deer every day all year) We have 6 to 8 deer out there everyday and sometime I've seen as many as 18 to 20 around dinner timeBetween 2016 and 2020 corn prices fluctuated between $3.25 and $4.50 Corn price today is $7.63 per bushel.