TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

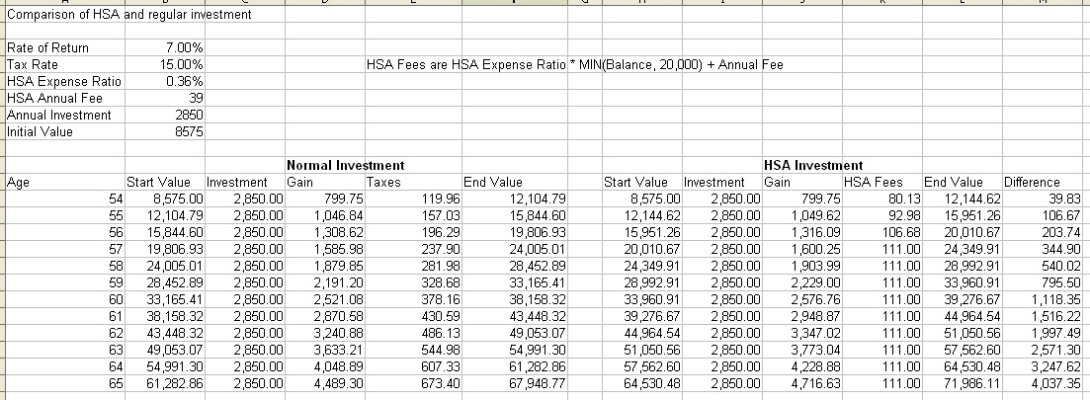

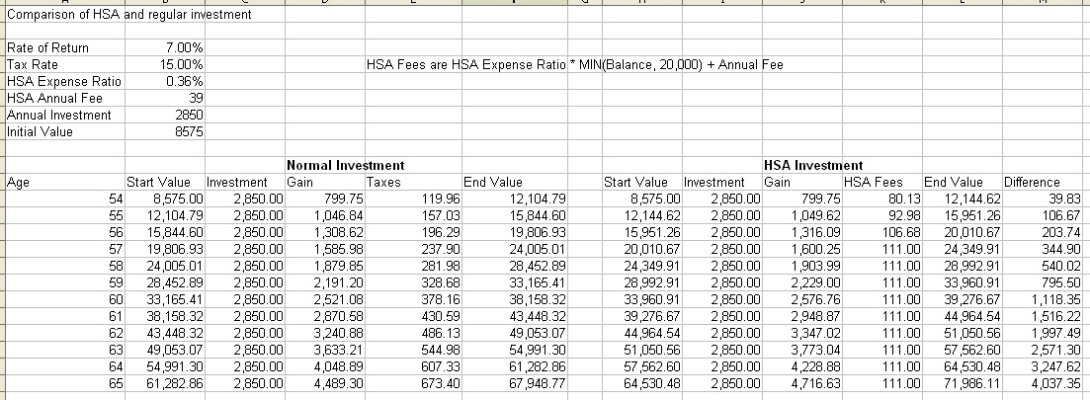

Here's my first draft at answering the question:

How much do I benefit from leaving money in my HSA account for ten years, as opposed to using the funds immediately for medical expenses?

That is, how much benefit do I get from the tax free compounding?

To make it simple, I assume that the account makes x% gain each year, all of which is taxed at y%. There are some other complications that I've ignored. For example, if the money is never used for medical expenses, I have to pay tax on it.

So at this point, I figure I'll have about $4K more at the end of 10 years if I leave the money in the HSA account.

Let me know what mistakes I've made and I'll revise the spreadsheet.

How much do I benefit from leaving money in my HSA account for ten years, as opposed to using the funds immediately for medical expenses?

That is, how much benefit do I get from the tax free compounding?

To make it simple, I assume that the account makes x% gain each year, all of which is taxed at y%. There are some other complications that I've ignored. For example, if the money is never used for medical expenses, I have to pay tax on it.

So at this point, I figure I'll have about $4K more at the end of 10 years if I leave the money in the HSA account.

Let me know what mistakes I've made and I'll revise the spreadsheet.