Sandy & Shirley

Recycles dryer sheets

Search for that in Google and each link takes you to a different answer.

There was a recent post on another thread by audreyh1 who at the point I am writing this has 17,698 posts where she said:

The motley fool article, https://www.fool.com/taxes/2017/12/22/your-guide-to-capital-gains-taxes-in-2018.aspx, published 12/22/2017 says that you start paying 15% at $38,600 and 20% at $425,800.

Everything else I see says that the 22% bracket starts at $38,700, not $38,600.

I’ve searched irs.gov and I can’t even find the taxation points for LTCGs.

I’m making all of my retirement plans based on not paying the 15% rate on LTCG and QD, and I do wish I was worried about the 20% rate but if I was I’d be asking my personal CPA, not posting here!

The thing I am trying to avoid is:

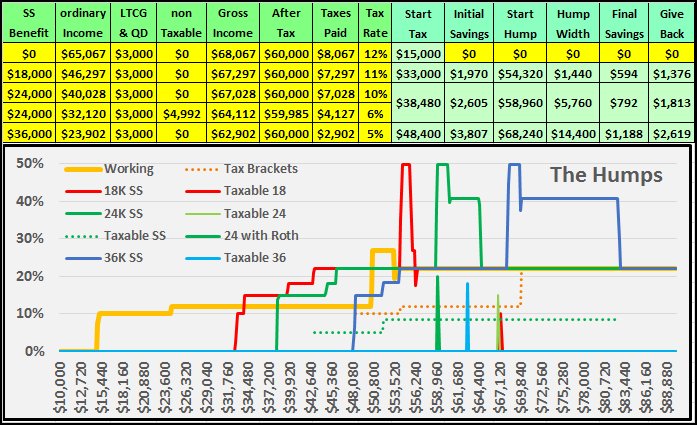

Earning a dollar which causes 85 cents of my SSB to become taxable, $1.85 at 12% is 22.2 cents, a marginal rate of 22.2%, but this also forces $1.85 of my LTCGs into the 22% bracket which are then taxed at 15% and 15% of $1.85 is 27.75 cents for a total tax increase of 49.95 cents because I earned or withdrew $1, the marginal tax rate of 49.95%. Hey, at least the feds are taking less than half our money now!

When the 49.95% marginal bracket ends, you are in the 22% federal bracket, but a dollar of income makes 85 cents of your SSB taxable and 22% of $1.85 is 40.7 cents, a 40.7% marginal tax rate, which ends when 85% of my total SSB has been taxed at which point I drop back to the standard 22% tax bracket.

My planning:

Determine how much of my IRA has to be converted to ROTH today at 22% and maybe even 24% to avoid the 49.95% and 40.7% marginal brackets during retirement.

So my question to the group, so I can share accurate information with others, is where do I find the accurate information on the tax brackets and the tax rates for LTCGs and Dividends.

There was a recent post on another thread by audreyh1 who at the point I am writing this has 17,698 posts where she said:

Sorry for using your quote Audrey; First of all there is no 39.5% bracket any longer!Three brackets.

On Taxable Income (AGI minus deduction(s)):

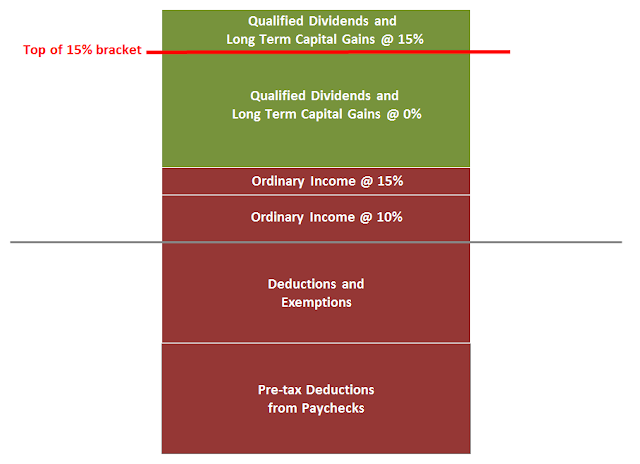

For the income up to the top of the 12% bracket limit - LTCG are taxed at 0%

For income above 12% and up to the 39.5% tax bracket, LTCG are taxed at 15%

For income above the 39.5% tax bracket, - LTCG are taxed at 20%.

Note that ordinary income counts first, so long term cap gain income which includes qualified dividends, gets pushed up to the higher portion of whichever brackets you cross.

The motley fool article, https://www.fool.com/taxes/2017/12/22/your-guide-to-capital-gains-taxes-in-2018.aspx, published 12/22/2017 says that you start paying 15% at $38,600 and 20% at $425,800.

Everything else I see says that the 22% bracket starts at $38,700, not $38,600.

I’ve searched irs.gov and I can’t even find the taxation points for LTCGs.

I’m making all of my retirement plans based on not paying the 15% rate on LTCG and QD, and I do wish I was worried about the 20% rate but if I was I’d be asking my personal CPA, not posting here!

The thing I am trying to avoid is:

Earning a dollar which causes 85 cents of my SSB to become taxable, $1.85 at 12% is 22.2 cents, a marginal rate of 22.2%, but this also forces $1.85 of my LTCGs into the 22% bracket which are then taxed at 15% and 15% of $1.85 is 27.75 cents for a total tax increase of 49.95 cents because I earned or withdrew $1, the marginal tax rate of 49.95%. Hey, at least the feds are taking less than half our money now!

When the 49.95% marginal bracket ends, you are in the 22% federal bracket, but a dollar of income makes 85 cents of your SSB taxable and 22% of $1.85 is 40.7 cents, a 40.7% marginal tax rate, which ends when 85% of my total SSB has been taxed at which point I drop back to the standard 22% tax bracket.

My planning:

Determine how much of my IRA has to be converted to ROTH today at 22% and maybe even 24% to avoid the 49.95% and 40.7% marginal brackets during retirement.

So my question to the group, so I can share accurate information with others, is where do I find the accurate information on the tax brackets and the tax rates for LTCGs and Dividends.