OP here.

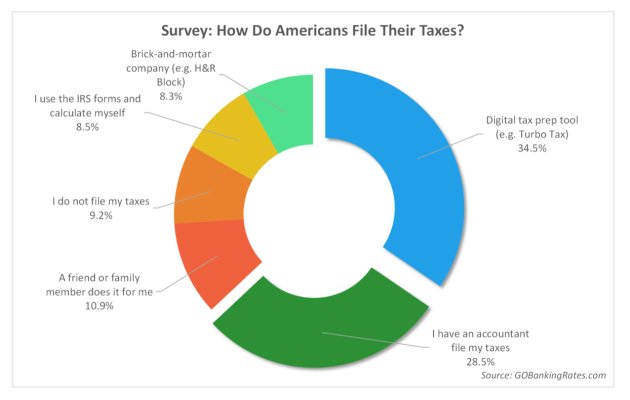

I think that this is exactly my point. I'm not even griping about "new" things that I did not know about. I have my own spreadsheets, I have 3rd party spreadsheets, I have Turbo Tax, and I'm fairly literate in the complexity of taxes. I knew that I would be paying my tax bracket rate on short-term gains and 15% on long-term gains etc. But for example, the NIIT caught me completely off guard. Maybe I've never even heard of it. If I had heard of it, I glossed over it because it never applied.

There is no defense of AMT, no matter how old it is.

Ohh - I dont think any one as commented on the use of AGI as a metric. I still don't understand why a person might be ineligible for a Roth, like @FDC319, just because they decided to sell some stocks. Or similar, If I decide to contribute to a tIra, I might be eligible to get the AOTC. But if I choose a Roth, I'm not. That should not matter.

I realize I'm asking for logic when there isnt any.

Ah, well, I see your point. I defend against the NIIT-style of surprise mostly by generally reading articles about tax topics, so even though the NIIT doesn't and hasn't yet applied to me, I know roughly where it starts coming into play. But for people who don't want to or don't like to or just were unlucky enough not to read the articles about NIIT, I think that's a valid criticism - the tax system has gotten so complex that it's quite unreasonable for people to try to read the whole thing every year and apply it to their situation.

The other defense I utilize against NIIT is that I complete my taxes based on what I know about my own financial situation and all the tax laws I happen to know. I try to read the "what's changed in taxes this year" articles and at the beginning of the IRS instructions and see if any of it applies. Beyond that, I don't go reading through everything every year looking for NIIT chestnuts that might bite me. If something falls through the cracks, then I will be reasonable when the IRS comes knocking, pay my additional taxes and interest and penalties, and hope to avoid jail time by demonstrating that I was reasonably diligent and honest.

I don't care too much about AMT, but the argument for it was that high income people with lots of deductions should still pay some tax. (Aside, I wonder how Amazon avoids AMT. It is popularly claimed that they make a lot of money and still pay $0 in federal income taxes. Not sure if it's true, but if it is, it doesn't exactly square with the argument for AMT.)

In general, although I don't think it's explicitly stated, the reason for most AGI-related phaseouts are that it is popular for Congress to social engineer in favor of the low income and in disfavor of the higher income. Take, for example, the coronavirus stimulus payment. It has an AGI phaseout of 5% starting at $75K individual and IIRC $150K MFJ. The stated or implied reason is that lower income people need the money more. Also, the lower income people will spend more of it, and since it's purpose is to stimulate the economy, it's more effective.

I don't really have any problem with any of this. I've arranged my financial life - and happen to have low interest in spending money - so that I am able to have a low AGI, very low taxes, and generally be quite content.

I do think that Congress has gone a little too far in the sense that they have made so many things phase out, so that the progressiveness of the tax code is too extreme for middle income earners. I've commented before that for every dollar I add to my AGI, it has many different marginal rates applied simultaneously:

1. Federal income tax

2. State income tax

3. ACA subsidy phaseout, which acts like a tax (about 15%)

4. FAFSA EFC increase, which acts like a tax (about 5%)

5. Coronavirus stimulus phaseout, which acts like a tax (5%)

In addition to these four, I also have AOTC, retirement savings tax credit, and possibly others I haven't thought of.

The fact that the phaseouts are all at various AGI levels just makes the planning that much more fun. And by fun I mean difficult.

I'll reiterate the original point along with another poster from earlier: Because the tax system is so complex, there are opportunities for the diligent to save money. It would be better if this weren't the case, but it is, so we might as well take advantage as best we can.