That's what my model screams at me every day: DO NOT PAY OFF YOUR MORTGAGE, YOU IDIOT! And if inflation ever gets above 2.75%, my mortgage is free.

+1

Historic opportunity with rates so low to pay as slowly as they will allow you to.

That's what my model screams at me every day: DO NOT PAY OFF YOUR MORTGAGE, YOU IDIOT! And if inflation ever gets above 2.75%, my mortgage is free.

You could google "defeasance" for pleasure!

I've always believed that the most important thing is to do whatever helps you to sleep soundly at night.

I paid off my 30 year mortgage at year 11. After that for the next 13 years I poured more money monthly into my index funds. It was the best financial call I have ever made.

Do you not see the shell game you (and others have) played on yourself here?

You poured money into your index funds with the increased cash flow after paying off the mortgage. But, where did the money come from to pay off the mortgage? You depleted something to pay it off, you ignore that, then talk about the advantage of refilling it.

If you didn't deplete it, you would not have to refill it! The mortgage pay off didn't appear out of thin air!

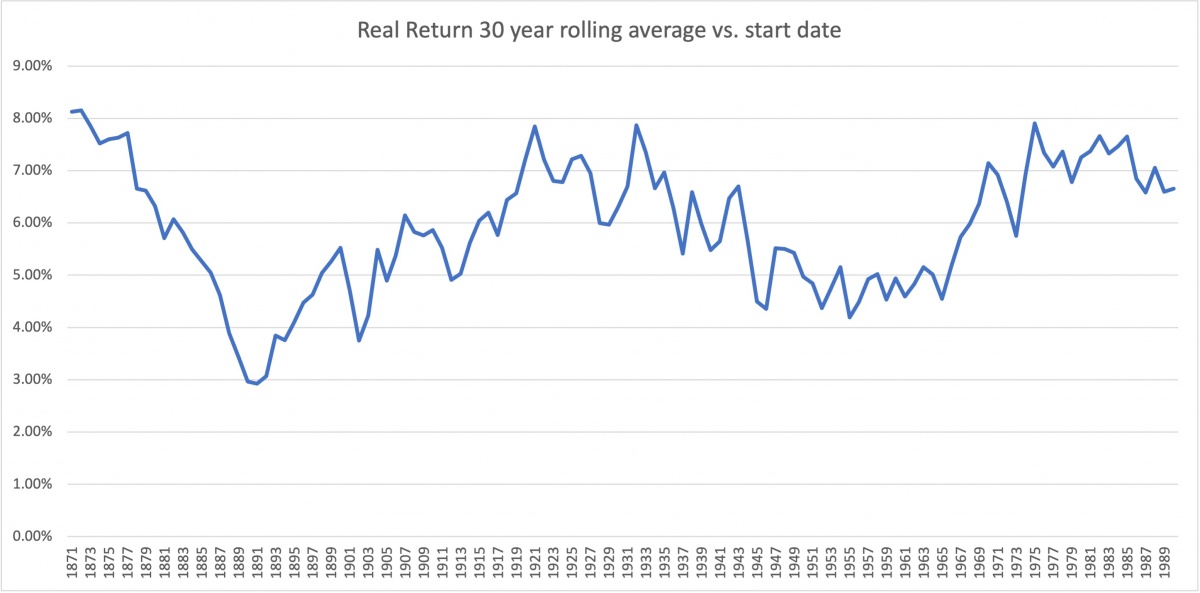

What year and what rate did you pay off your mortgage? A 60/40 fund has nearly tripled in the past 13 years ($100,000 goes to $279,483 - no guarantee of course, but historically investments have outpaced these low mortgage rates over any 20 or 30 year period).

https://bit.ly/2YCQXKe <<< link to 60/40 returns since 2007

-ERD50

But I don't think that is good advice at all if the sound sleep is built on a poor understanding of the issue.

If some one "hates" borrowing money at 30 year fixed historically low rates, I don't think they understand the issue. After they understand the issue, they may still decide to take a pass, but if "hate" is involved, there's something clogging rational thinking.

Financial interest (and most others) are best served with rational thinking. If something emotional is creeping in, figure it out. Often, fear is overcome once we understand and confront that fear.

-ERD50

I paid off my 30 year mortgage at year 11. After that for the next 13 years I poured more money monthly into my index funds. It was the best financial call I have ever made.

If I don't need enough income to make the payments, I can probably have low enough income that will qualify me for ACA subsidies and low taxes.

+1Originally Posted by Nick12 View Post

I paid off my 30 year mortgage at year 11. After that for the next 13 years I poured more money monthly into my index funds. It was the best financial call I have ever made.

+1I've always believed that the most important thing is to do whatever helps you to sleep soundly at night.

I've always believed that the most important thing is to do whatever helps you to sleep soundly at night.

I don't quite follow the reasoning here. Why couldn't you use the big lump of already taxed money that you'll need to pay off the mortgage to lower your income needs (or increase roth conversions) instead? I would think that would be more effective in reducing needed income and effective tax rate each year than eliminating your measly (by comparison) monthly mortgage interest payment.

e.g. Paying a 2.75% rate over 30 years to keep a larger share of money in the 12% or lower bracket would seem to me to make sense. Or it could allow you to do much larger Roth conversions up to the top of the 22% bracket, which would be a win as well I would think. Or is my reasoning flawed (I'm not a spreadsheet guy). And that's not even bringing possible extra investment gains, which can be tenuous, into the picture.

I'm not quite following. I don't know the intricacies of Covered California yet but I believe I'll need to be under $80k/year in income to qualify for subsidiaries. My mortgage is about $25k/year. Taxes, hoa and insurance is another $20k/year. So that would leave 35k of income left for everything else...

Income does not have to equal expenses. If, for example, you have $80K in a mutual fund with $60K basis, then by selling it you get $80K to cover your expenses on just $20K of taxable income.I'm not quite following. I don't know the intricacies of Covered California yet but I believe I'll need to be under $80k/year in income to qualify for subsidiaries. My mortgage is about $25k/year. Taxes, hoa and insurance is another $20k/year. So that would leave 35k of income left for everything else which would not be enough unless I give up travel, however travel is the main draw of early retirement.

Also, while long term performance will likely exceed my mortgage rate, short term performance is less certain. I think I would feel more comfortable in retirement without any debt obligations.

Income does not have to equal expenses. If, for example, you have $80K in a mutual fund with $60K basis, then by selling it you get $80K to cover your expenses on just $20K of taxable income.

I'm not saying you should or should not do this. Just showing an example of what I think was meant in the comment directed toward you.

If all of your money is in tax deferred, then of course it's all taxable as you withdraw for expenses. But if you withdraw a bulk sum to pay off your mortgage, you're really going to get whacked that year in taxes.

Income does not have to equal expenses. If, for example, you have $80K in a mutual fund with $60K basis, then by selling it you get $80K to cover your expenses on just $20K of taxable income.

I'm not saying you should or should not do this. Just showing an example of what I think was meant in the comment directed toward you.

If all of your money is in tax deferred, then of course it's all taxable as you withdraw for expenses. But if you withdraw a bulk sum to pay off your mortgage, you're really going to get whacked that year in taxes.

I won't carry a mortgage into retirement, even if I have to move...saw people get stuck with a hefty mortgage after they unexpectedly were laid off who never managed to find another job but couldn't give up the house where they'd been living for the past 30+ years.

I have resolved this problem. I paid off my mortgage and got a HELOC at 2.24% (-1.01% of prime rate) .. gives me flexibility with the revolving credit.

My first question on this is always: Right now, if you had no mortgage, would you mortgage the house to invest in the market? Because that is basically what you are doing.

That said, it depends on how much the mortgage is and what are the payments. If you have a large amount of cash earning less than 1%, maybe put some of that towards it.

Despite the fact that we (the FIRE community) LOVE to discuss the topic, paying off the mortgage is a very personal decision.

Full disclosure: We (DW and I) always had the attitude that all the money from a sale went into the next house, keeping the mortgage low. When the last house was paid off, we sold for a tidy profit, bought the current townhome/condo, and invested the rest.