Mortgage or Not?

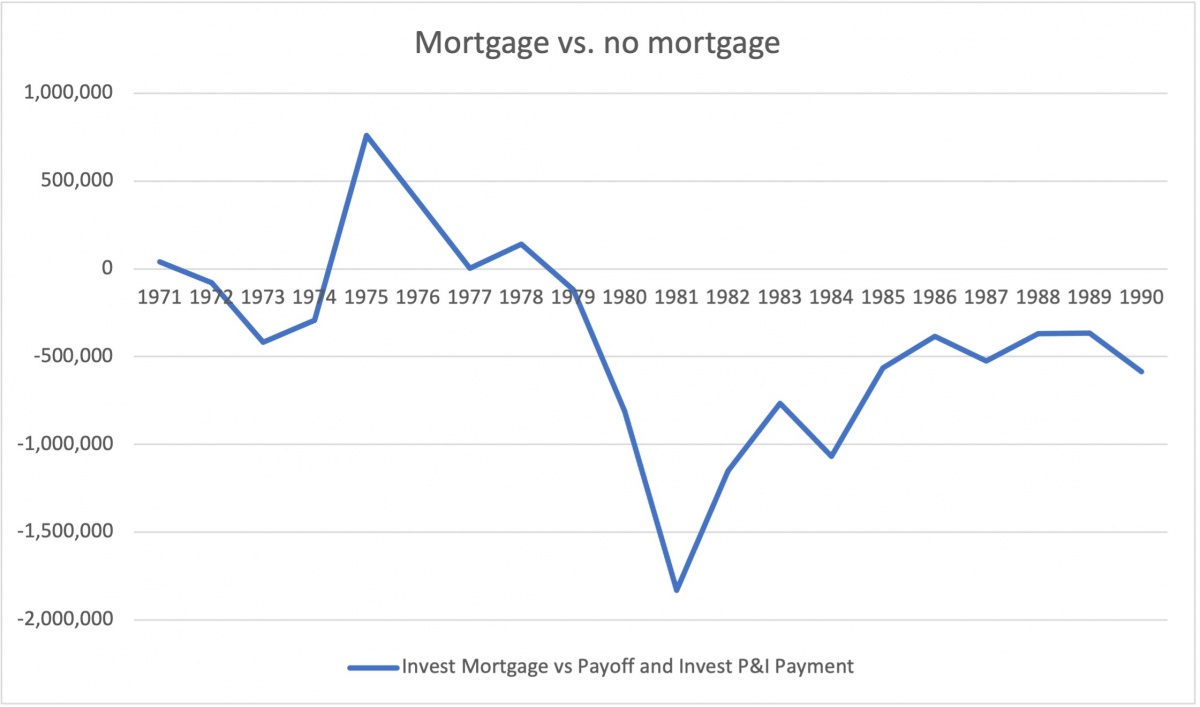

I have posted the following before. My comments only deal with portfolio risk and math. The post ignores the other important factors that matter to us individually. From a math and portfolio risk standpoint, the bottom line is this. It depends on where you get the money to pay off the mortgage or where you invest the money you could have used to pay off the mortgage. Often when this topic arises, it seems we are not comparing apples to apples. We are either increasing risk (higher dollars invested in stocks - keeping a mortgage) or reducing risk (lower dollars invested in stocks - paid off mortgage). IMO, changing portfolio risk seems to be the overlooked variable. If we hold risk even, it only matters which rate is higher, bond returns or the mortgage interest rate. And, holding risk even is essential to accurately compare two investment choices, pay off the mortgage or keep the mortgage.

Now, back to the bacon thread where I am loved by all. If I remember correctly, this post does not engender widespread love and affection.

Previous post (with edits)

Previous post (with edits)

If bond returns are less than your mortgage rate, and we are holding portfolio risk even, financially you are better off to liquidate bonds and pay off the mortgage. You increase your total return by the spread between the mortgage rate and the bond rate. If bonds pay more, the reverse is true and you should keep the mortgage. (This analysis ignores any tax implications of having a mortgage or selling bonds.)

With a mortgage

60/40 Asset Allocation

$600,000 Stocks

$400,000 Bonds

$1,000,000 Investable assets

$0 Home equity (100% mortgage)

$1,000,000 Net worth

Without a mortgage

100/0 Asset Allocation

$600,000 Stocks

$0 Bonds

$600,000 Investable assets

$400,000 Home equity (paid mortgage)

$1,000,000 Net worth

Where bond rates and mortgage rates are equal (say 3%), the two examples above have similar portfolio risk and return (assuming bonds and mortgages have similar risk). Some will argue the second example has a different asset allocation, 100/0 vs 60/40. But, that is only because we are not counting the paid off house in the second example. IWO, we are not comparing apples to apples. We are already counting potential home equity in the first scenario. It shows up as the $400K bond investment. Once the home equity is moved up to the investable assets in the second example, both examples have a 60/40 asset allocation. While most here do not normally include home equity in our investable assets, it needs to be included in this calculation to make a proper comparison equalizing the risk and defacto investments of both choices. IWO, example one could pay off the mortgage with his bonds or example two could mortgage his house and invest the proceeds in bonds. Both examples are the same risk and return when mortgage rates and bond returns are equal.

Finally, some are using total portfolio return compared to the mortgage rate. I believe this is a misstep. The mortgage rate should be compared to your lowest returning asset. For most this will be bonds. Money is fungible. I can hold bonds at 2% or use bonds to pay down a mortgage with a 3% interest rate. I do not have to liquidate stocks (or other high yield assets) to pay down the mortgage. Strictly from a math standpoint, it would only make sense to keep a mortgage when all of your assets have an expected return greater than the mortgage rate.

There are other reasons someone may wish to keep a mortgage or have a paid off house. The above only addresses the math calculation and the need to equate portfolio risk between the two examples allowing proper comparison. Additionally, an investor may not want to bring bonds all the way to zero since it would preclude rebalancing. Finally, the mortgage example likely provides more flexibility and liquidity. Once again, the above only considers the math and challenges the common assumption that the total portfolio return is the proper measure against the mortgage rate.