corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

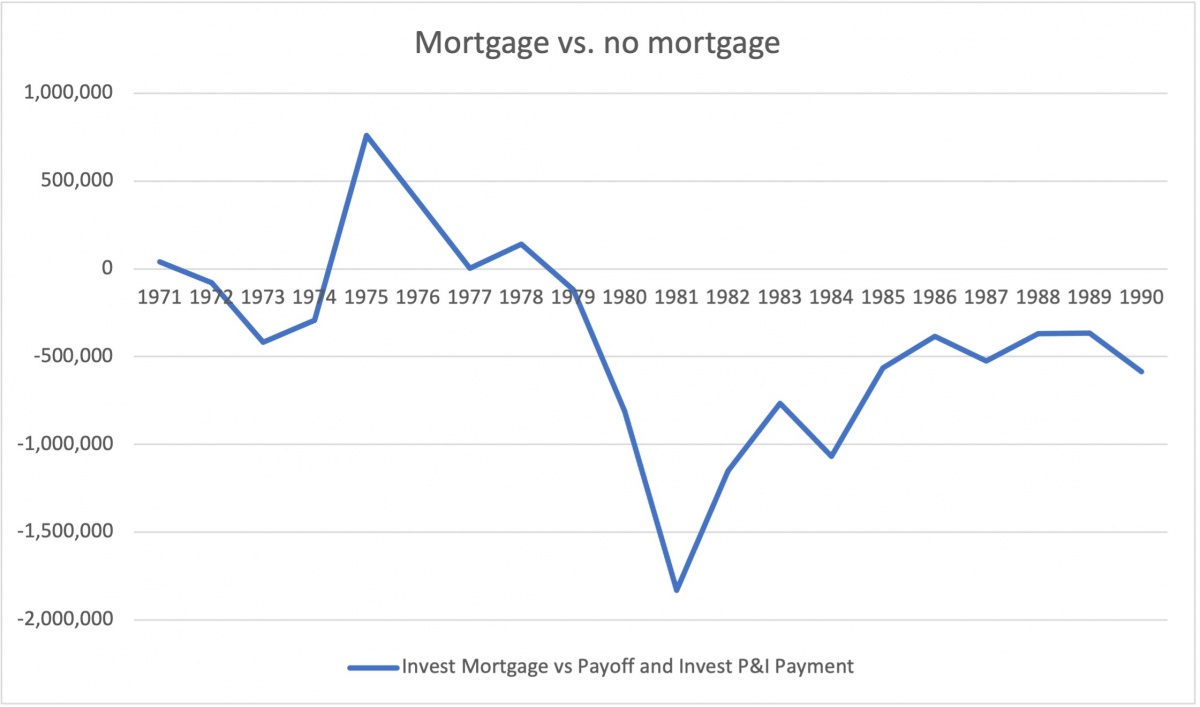

Corn, I am confused. You did a 20 year run (30 years ago) for a 30 year mortgage. And also, where is the 200K that you would still have if you got a mortgage? What I mean is if you had no mortgage (meaning you paid cash) then where is the 200k coming from? Both scenario's can't start with zero invested. The no mortgage scenario can have zero investing because he used his 200k to buy the house. Where is the 200k for the "got a mortgage" scenario? Maybe I'm just confused. Happens way to often. lol

The comparison is for someone who has $200,000 on day one. They either pay cash for the house and invest what would have been the house payment or they take a $200,000 mortgage and invest the $200,000.