Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

But isn't the roughly 4 trillion dollars of cumulative deficits we've incurred from 2009-2011 a fiscal stimulus? It has been a while since I've take Macro, but I thought government deficit spending was a stimulus? Or is there some magic,that unless a government spending isn't lumped together and called a stimulus bill, it doesn't have any impact on the economy?

That's a fair question.

And the answer is that some is and some isn't.

The deficits we were running in 2007 (2.5% of GDP) at full employment haven't gone away. They're part of the debt we've incurred over the past three years. But they're also part of pre-recession GDP output. We can't add them again as new "stimulus." They're already baked in the cake.

What about the 4% of GDP increase in deficits due to declining revenues? That's not stimulus either. Consider someone who loses his job and moves from being a taxpayer to not a taxpayer. Does his lower tax burden increase his economic activity? Of course not.

So here we've accounted for 6.5% of GDP, out of a peak 10.6% deficit, that isn't stimulus. The balance mostly does support economic activity to varying degrees and has some stimulative impact.

But remember, too, that the ~$3T output gap projected back in 2009 already assumed much of these higher deficits. Whatever stimulative effect they have, was known even then to be insufficient.

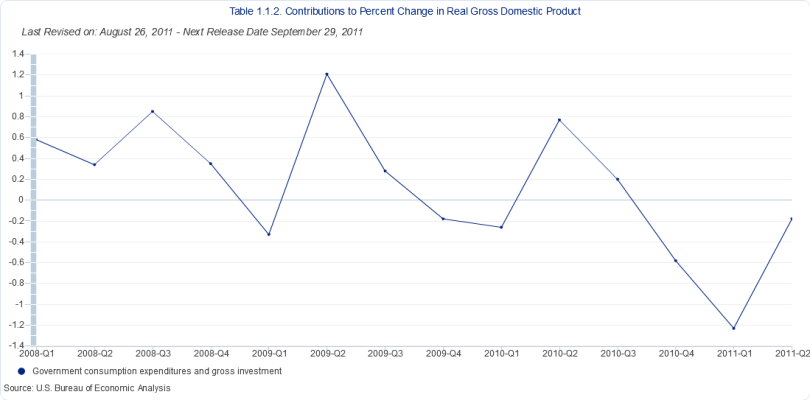

Here, BTW, is a chart of the contribution from Government Consumption and Investment to GDP. This isn't from some liberal economist, but from the actual GDP data reported by the BEA. What you'll see is a small spike in the 2nd Quarter of 2009, which was the Stimulus Bill and then a declining trend thereafter. You'll also notice that government has been a net drag on growth in each of the past three quarters.

Attachments

Last edited: