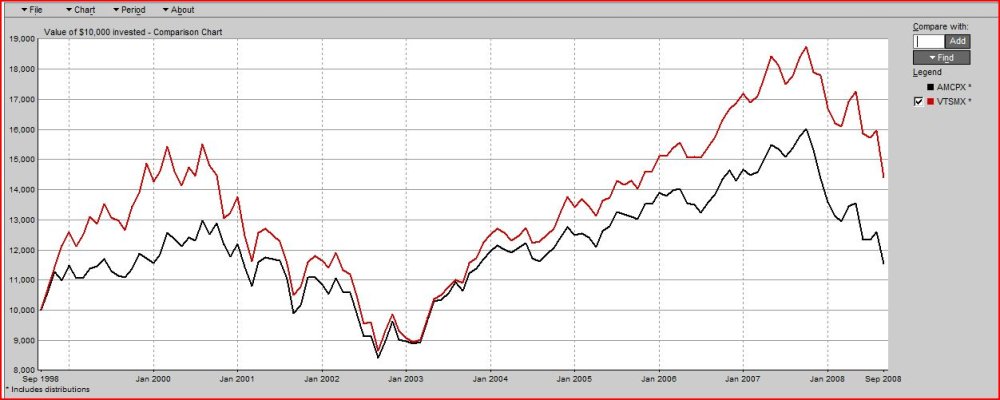

I've got books right in front of me, and in looking at EVERY A (all 15)share stock fund (including balanced and income) that they have, have outperformed the S&P over the last 10 years, and only AMCAP, Balanced fund and Washington Mutual have underperformed it slightly over the last five years. Over a one year period (as of the end of 2nd quarter) only AMCAP, New Economy, Smallcap World, and Washington Mutual have slightly underperformed the index.

They only have 15 funds that fall into the stock category, so bunny's claims of making it sound like they're fund loaded is wrong. They do have various share classes.

BTW, choosing AMCAP sure seems like cherry picking, seeing that it's their worst performer. However, it still wins out over a 10 year period by doubling the return of the S&P, so go figure.

Again, FD has posted actual statistics countless times, but it seems on this board, when shown facts, the topic just moves on elsewhere. I don't have the patience he possesses.

BTW, expense ratio on AMCAP is .65%. OUTRAGEOUS! And a turnover ratio of 29% is incredibly low for an actively managed fund, although they have some lower and some higher. Who wants a zero turnover?? You'd be better off with an ETF or UIT then.

One more note, over the fund life of AMCAP (5/1/67), it has earned 11.66% average annual rate of return vs. the S&P in the same time frame's 10.01%. If facts mean anything of course.