corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

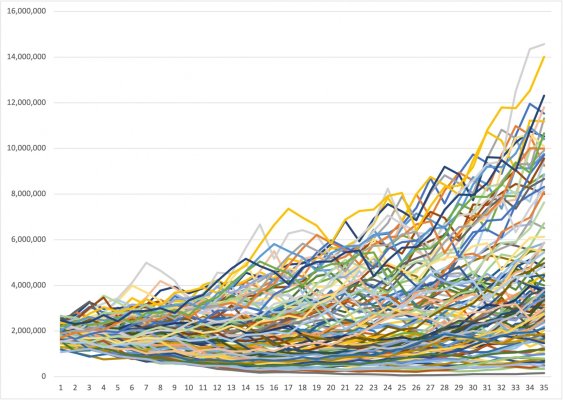

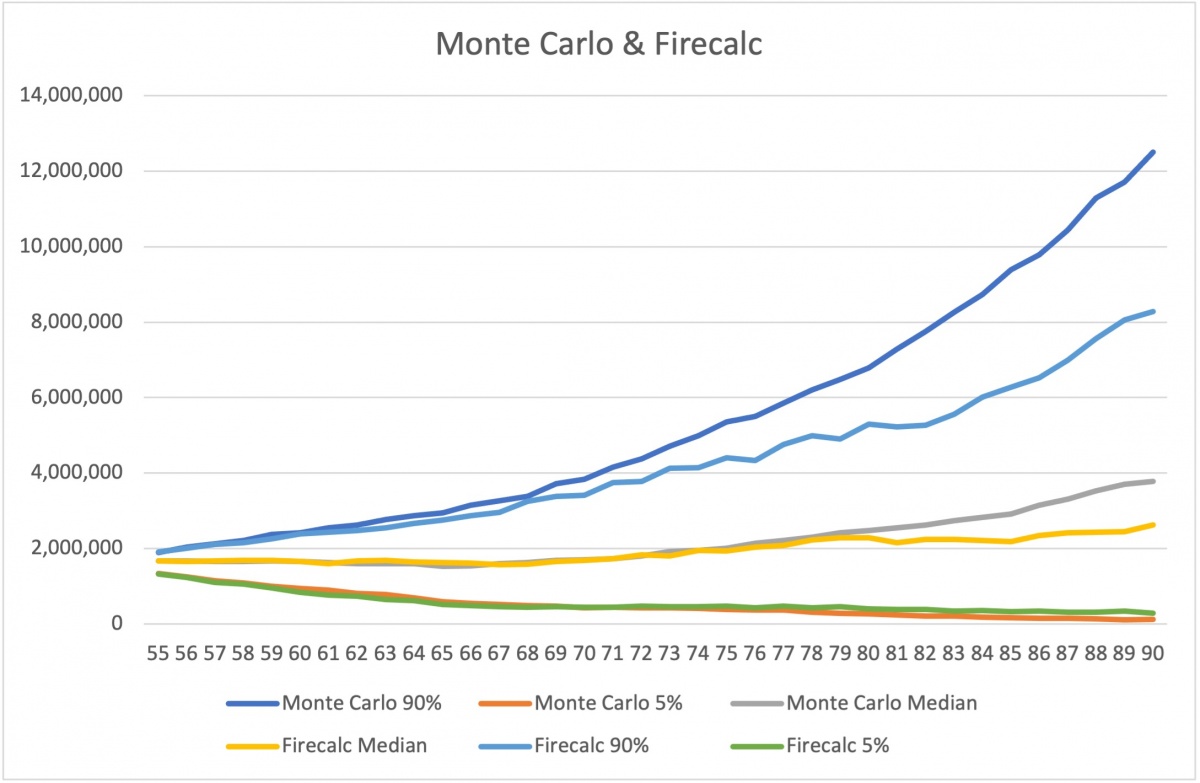

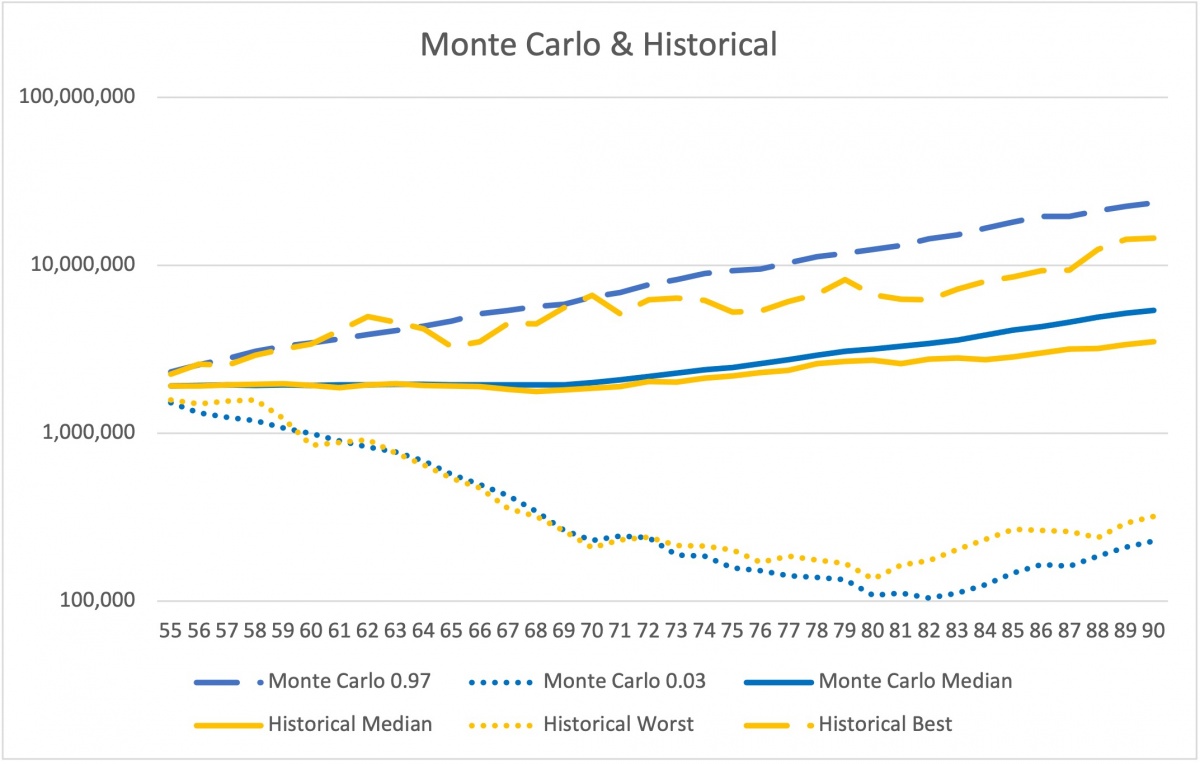

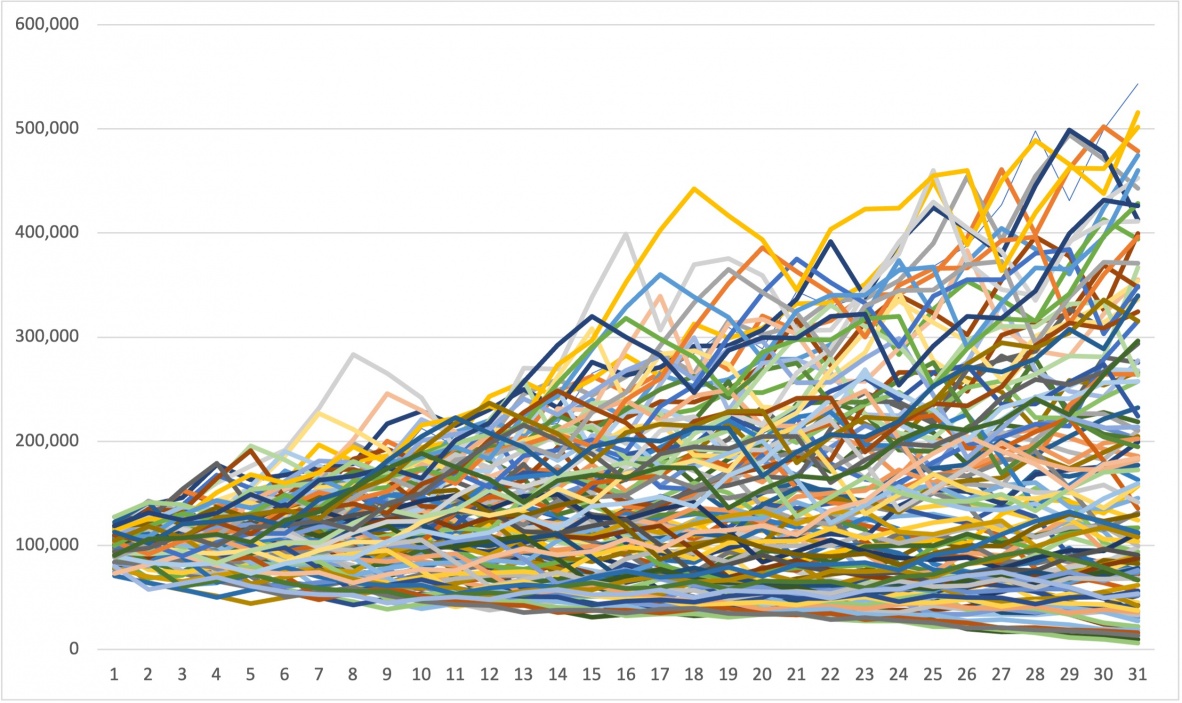

I incorporated historical returns from 1871 to 2020 into my spreadsheet so I could see what happens for different start years. I got tired of entering dates a year at a time, so I went full bore and calculated my balance for 115 different start periods like firecalc. I ran a simple test case against firecalc of $100,000 starting balance w/ $4,000 withdrawals. Then spent the next 2 hours trying to figure out why my model and firecalc were off a bit (1%). Turns out firecalc is much more complicated than simple real returns. I downloaded the one year firecalc spreadsheet and there is a lot going on. For now, I'm not going to fix that 1% because it is very complex.

What I have now is the ability to spit out my 115 lines directly from my spreadsheet. And it spits out the worst year for me so I can plug that into my model to look at the single year. And it spits out a Ps. This make me very happy because now I can easily see all my what if's without having to bounce back and forth to firecalc.

Life is good. 100% Ps. 61 days and a wakeup.

What I have now is the ability to spit out my 115 lines directly from my spreadsheet. And it spits out the worst year for me so I can plug that into my model to look at the single year. And it spits out a Ps. This make me very happy because now I can easily see all my what if's without having to bounce back and forth to firecalc.

Life is good. 100% Ps. 61 days and a wakeup.

Attachments

Last edited: