NYEXPAT

Thinks s/he gets paid by the post

Yeeeeehah! Ride 'em, cowboy!

Thanks for that, I love a good chart!

Yeeeeehah! Ride 'em, cowboy!

All I want for Christmas is some VTSAX, some VTSAX, some VTSAX...

No expert here, but my reinvested dividends are buying more stock. Isn't that what counts in the long run?

-1. Not yet.

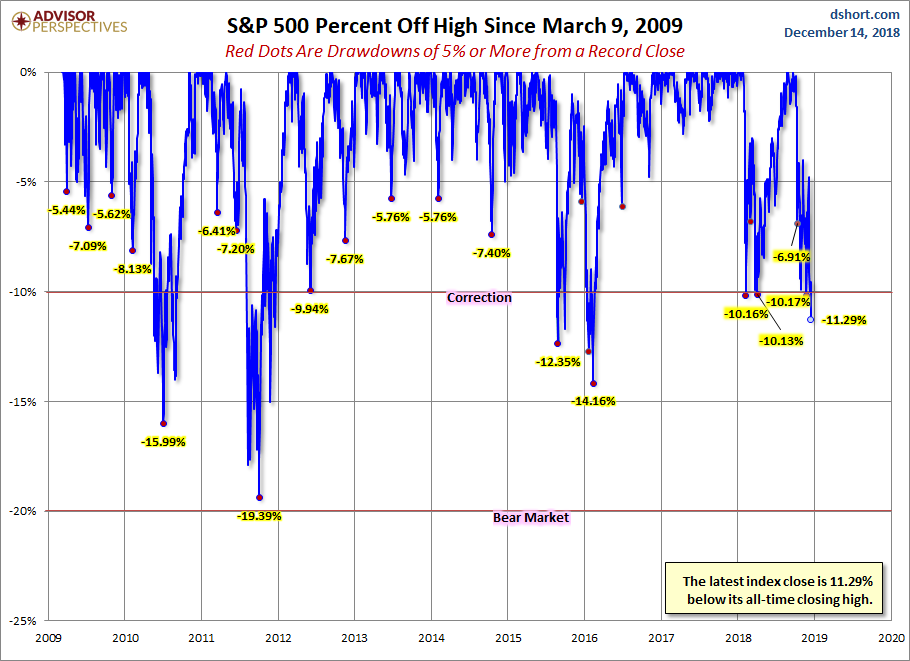

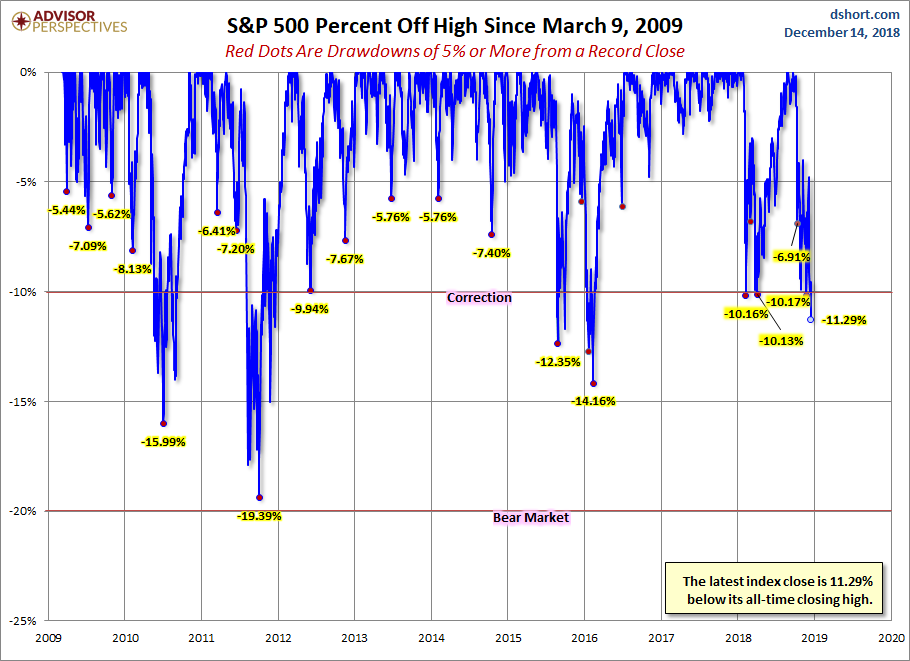

The S&P high was 2940.91. It closed today at 2467.42. That's -16.1% down. Only 4 more percents to go. It may make it there before New Year. Plenty of time for us to celebrate NY and start 2019 in the pits. Why rush it?

But, but, but it increases my WR.

I took advantage of a pretty good Holiday sale today. I shopped at the stock market. Just a bit.

NW-Bound said:What? Is it 20% sale already?

I took advantage of a pretty good Holiday sale today. I shopped at the stock market. Just a bit.

Me too, put about 25% of my "dry powder/wait for the inevitable downswing to buy" money to work on VTI.

Bear market? Are layoffs coming?? I want to go out with a severance package!

There is a ton of “confidence” in this thread that what’s happened already is either a buying opportunity or close to one. I’ll suggest that even though there will likely be short term big bounces, we still have a lot farther down to go and that the next 7,000 point Dow move will be down, not up.

The US govt and corporations have incredible amounts of debt that dwarf the Great Recession. Much of the market’s awesome 10 year gains were built on the back of “easy money.” Each successive QE proved much less effective than the previous one implying that there’s a limit to borrowing our way to prosperity. Yes, stocks look cheap compared with near term earnings. But ultimately the market is a forward-looking mechanism that cares about long term expected performance. Serious weakness in housing, global oil demand and other things imply that the ultimate consumers of goods and services may be more tapped out than near term earnings suggest. Be wary of catching a falling knife. Often the time to get excited is when you can’t find anyone who feels the market is a deal, your neighbors give you dirty looks when you talk stocks, and people quietly nurse their losses.

...Also, markets don't like uncertainty, and I can't think of any time in the last several decades when there was more uncertainty in the world than right now...

Bear Market, not to be confused with a recession!

The markets had a meteoric rise over the past 8-9 years fueled by 0% interest rates, so now a pullback, because Fed Funds rate is at 2.25% (Still 0% nominally), that really illustrates the entire market is indeed an easy money fueled bubble. Is it really rational to call any form of retracement tied to the normalization of rates a correction or bear market?

Thus, I'm voting "0"!

There is a ton of “confidence” in this thread that what’s happened already is either a buying opportunity or close to one. I’ll suggest that even though there will likely be short term big bounces, we still have a lot farther down to go and that the next 7,000 point Dow move will be down, not up. After the Great Depression stock drop of 90% in 1929-1932, stocks rallied big time on govt. intervention. Then as that intervention waned, stocks dropped 60% in 1937.

So you think there is more uncertainty now than the bottom of the dot.com crash, the day after 9/11, or the depths of the Great Recession? Wow.