Throwing out a couple more budgeting tools I've been exploring as Quicken leaves me frustrated in many ways.

PowerWallet.com - I find this tool to be decent. The reporting could use a work but it does allow you to see pretty clearly your cash inflow and outflow. You can set up bills on a calendar and have pretty good flexibility on setting up budget categories/subcategories. Plus it's free.

GoodBudget - This is purely a budgeting tool. You can't synch your accounts but it offers a ton of flexibility and from what I can see it has good reporting. You have to upload your transactions manually which may or may not be a bummer, depending on how you do your budgeting. It's got two-tiered pricing. You get 10 "envelopes" (which are just budget categories and subcategories) for free. For $50 per year you get unlimited categories.

HomeBudget is a program I played with for a while but moved away from. I was having problems syncing accounts for automatic download, but after dealing with Quicken for a year I am less concerned about that and thinking about revisiting it. If memory serves me correctly it was fairly powerful and offered a decent amount of flexibility.

Exact Finance is another program that I just stumbled across this week. It's still in beta, but looks promising. The developers are looking to charge $10 per month for it, but the intention is to be a one stop shop for all things personal finance. Budgeting, forecasting future cash flow and tracking investments. It looks promising but I need to see more.

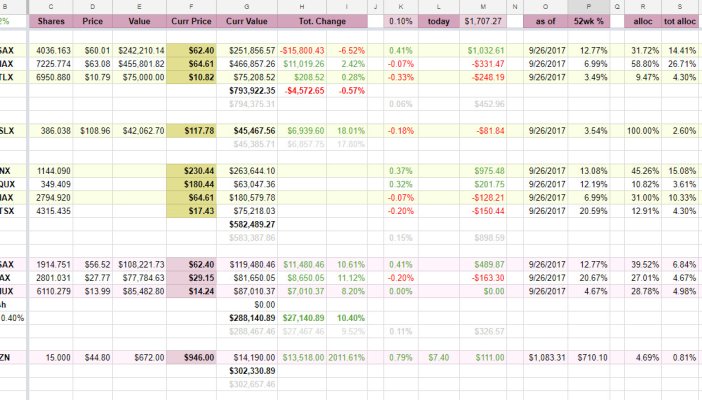

Currently we use a combination of Mint, Quicken, and Personal Capital. Mint is used so my wife and I can track our spending during the month. Quicken is where I aggregate data and assess at a high level how we are doing budget wise. Personal Capital I use for investments.

The OP mentioned CountAbout, which I explored about a year ago. I had some frustrations with the program, but I think I may revisit it. Most of my frustrations were around importing data from accounts.