You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Improvement in CD rates?

- Thread starter TNBigfoot

- Start date

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Short-term interest rates are not improving, the 10-year is and 10-year CD rates have improved, going from at/under 1.0% to 1.8% today (for brokered CDs).

twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

The 5-year rate has doubled this year. But it is still unbearably dull.

RetireBy90

Thinks s/he gets paid by the post

I would suspect they will be like gas prices, except in reverse. As Tate’s go down CD rates followed pretty quickly, but will be slow to rise. PenFed this week offered 0.45% for 12 month. Sad IMHO

TheRunningMan

Recycles dryer sheets

- Joined

- Jun 27, 2017

- Messages

- 98

My American Express savings account rate dropped to .4% yesterday from .5%...it is difficult to imagine rates for savers improving in the near term.

aja8888

Moderator Emeritus

My American Express savings account rate dropped to .4% yesterday from .5%...it is difficult to imagine rates for savers improving in the near term.

I suspect when the FED loses control of inflation, or it starts getting reported without biases (not likely), then rates may rise for CD's. However, banks really like the current CD rates and will be hesitant in changing to any higher rate until forced to from competition.

- Joined

- Nov 17, 2015

- Messages

- 13,948

I would not expect to see any CD or bank yields increase until at least 4Q.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just got an update from deposit accounts that several credit unions I am monitoring have reduced rates on CDs. Most are ~5-10 bps. NFCU lowered the 3yr variable rate by a single bp from .39 to .38! Why bother?

Here’s the link to DAs latest forecast. Other than brokered CDs, rates are expected to stay low as banks absorb buckets of stimulus deposits they won’t see any need to attract deposits by raising rates.

https://www.depositaccounts.com/blog/fed-deposit-interest-rate-predictions/

Here’s the link to DAs latest forecast. Other than brokered CDs, rates are expected to stay low as banks absorb buckets of stimulus deposits they won’t see any need to attract deposits by raising rates.

https://www.depositaccounts.com/blog/fed-deposit-interest-rate-predictions/

Finance Dave

Thinks s/he gets paid by the post

- Joined

- Mar 29, 2007

- Messages

- 1,861

It would be nice to track a table of ST products every few months over the next 2-3 years so we can see how things change...but I'm too lazy to sign up to do it lol.

My CD ladder will benefit from medium-term rates improving (IF they do improve) as I replace the 5 year CD each year. My next one matures in November.

My CD ladder will benefit from medium-term rates improving (IF they do improve) as I replace the 5 year CD each year. My next one matures in November.

Mark1

Full time employment: Posting here.

I periodically make a note of the highest rate (5yr CD) available for Brokerage CDs at Fido. I'm not ready to buy any CDs yet, but rates are on their way up.

mid-Jan = 0.55%

mid-Feb = 0.65%

mid-March = 0.90%

mid-Jan = 0.55%

mid-Feb = 0.65%

mid-March = 0.90%

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yikes! I wonder why brokered rates are going up whiles others are still getting whittled.

Last edited:

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yikes! I wonder why brokered rates are going up whiles others are still getting whittled.

Are you comparing apples to apples with the 5 yr rates?

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I periodically make a note of the highest rate (5yr CD) available for Brokerage CDs at Fido. I'm not ready to buy any CDs yet, but rates are on their way up.

mid-Jan = 0.55%

mid-Feb = 0.65%

mid-March = 0.90%

I've said it before. I'll keep my money under a mattress before I'll let someone have it that cheap. Call it cutting off my nose, etc. and I won't even argue. Just my thing, so YMMV.

RetiredAt55.5

Full time employment: Posting here.

I've said it before. I'll keep my money under a mattress before I'll let someone have it that cheap. Call it cutting off my nose, etc. and I won't even argue. Just my thing, so YMMV.

So what happens if your house (with mattress) burns down?

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Are you comparing apples to apples with the 5 yr rates?

Not sure what you are referring to. I’m not really comparing anything but I’ve seen two references to brokered rates trending up compared to regular rates.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not sure what you are referring to. I’m not really comparing anything but I’ve seen two references to brokered rates trending up compared to regular rates.

Understood.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Loses control? No doubt the trillions they are printing and handing out won't hurt....I suspect when the FED loses control of inflation, or it starts getting reported without biases (not likely), then rates may rise for CD's. However, banks really like the current CD rates and will be hesitant in changing to any higher rate until forced to from competition.

Leo1277

Recycles dryer sheets

That's why many European banks now "offer" negative interest rates. The flip side is that real estate mortgages are cheaper than dirt cheap. My brother over there just finalized a 10 year fixed rate mortgage for his home for 0.22% and zero points - it's just unbelievable.So what happens if your house (with mattress) burns down?

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That's why many European banks now "offer" negative interest rates. The flip side is that real estate mortgages are cheaper than dirt cheap. My brother over there just finalized a 10 year fixed rate mortgage for his home for 0.22% and zero points - it's just unbelievable.

Could be an arbitrage opportunity with other investments for those with foreign based real estate holdings.

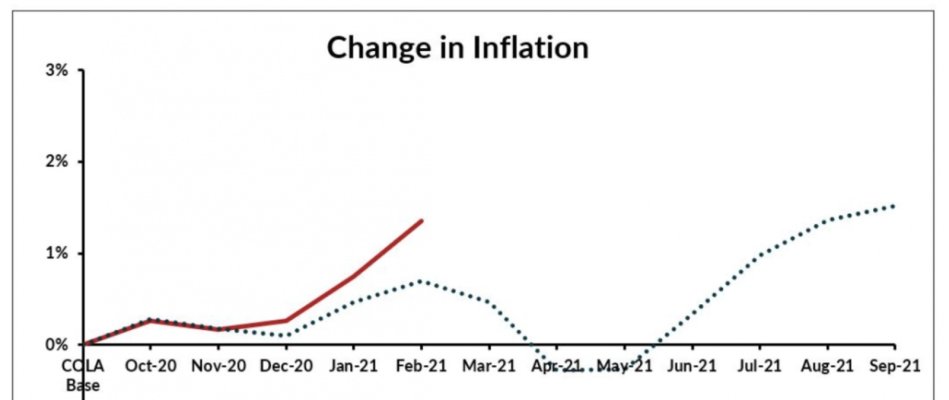

Meanwhile 2021 inflation is projected as 1.7% by the Feds. Yet when you go shopping, you wish it was true.

For those of us who get a COLA at the end of the year, it's beginning to look like it might actually be significant.

Attachments

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So what happens if your house (with mattress) burns down?

Sorry. Under the mattress was metaphorical. I might keep some in the checking account (Yeah, I know - that's even worse!). If I don't need the money anytime soon, I'm just as likely to donate it (kids or charities, etc.) But I'm serious about not committing money at ridiculously low interest rates. If they won't pay much interest, I'll keep it totally flexible - not "tied up." As always, YMMV.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

For those of us who get a COLA at the end of the year, it's beginning to look like it might actually be significant.

How about for us born in 1960?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

From what I read, you're hosed unless Congress intervenes with some sort of fix.

Similar threads

- Replies

- 17

- Views

- 724

- Replies

- 35

- Views

- 2K

Latest posts

-

-

-

-

-

-

-

MYGA Company Ratings. AMBest "A vs A+ vs A++" Does it really Matter?

- Latest: ShokWaveRider

-

-