|

|

05-25-2021, 06:36 AM

05-25-2021, 06:36 AM

|

#61

|

|

Recycles dryer sheets

Join Date: May 2021

Location: Charleston

Posts: 105

|

So.

VTI beats Dividend paying funds in a large/long bull market.

Great.

Again.......I am not an either/or investor. I think both have a place in my portfolio. I am accumulating for the long term future with income, dividend payers and growth/total market.

The OP seems to be doing the same. If he/she wishes to get advice/see options I will gladly oblige.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-25-2021, 06:39 AM

05-25-2021, 06:39 AM

|

#62

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,721

|

Quote: Quote:

Originally Posted by RxMan

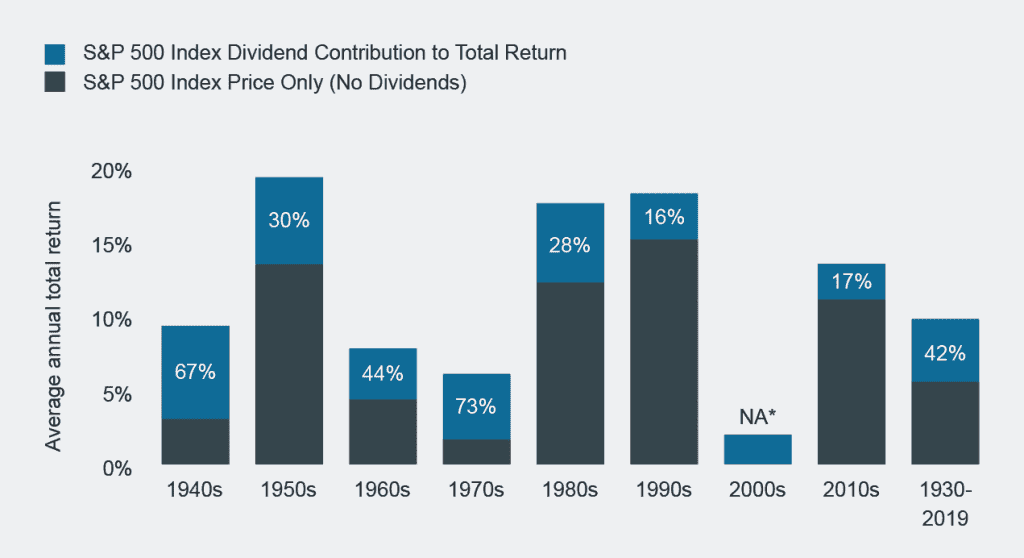

Source: Morningstar/Hartford Funds, 02/2020. S&P 500 Index is a market capitalisation weighted price index composed of 500 widely held shares. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualised return over the decade.

Source: Morningstar/Hartford Funds, 02/2020. S&P 500 Index is a market capitalisation weighted price index composed of 500 widely held shares. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualised return over the decade.

Interesting to note that the lower the total returns are by decade the greater the importance of dividends on total return. This could be especially important for retirees if there is a repeat of the 2000s decade where there wasnít a positive return.

The best information Iíve come across regarding dividends and their impact on total returns is here:

https://www.hartfordfunds.com/dam/en...pers/WP106.pdf

There is some comparisons of dividend paying stocks verses the S&P 500 weighted index regarding total returns and beta. (See Figure 7 on Page 6 of this report)

I thought this information was relevant to this discussion. |

Thanks for posting this. Another point was interesting.

Quote: Quote:

The second-quintile stocks outperformed the S&P 500 Index seven out of the ten

time periods (1930 to 2020), or 77.8% of the time, while first- and third-quintile stocks

tied for second, beating the Index 66.7% of the time. Fourth- and fifth-quintile stocks

lagged behind by a significant margin.

|

If I'm remembering correctly, the second quinitile has payout ratio less than 50%. There's more certainty that the dividend will continue for those companies.

|

|

|

05-25-2021, 07:02 AM

05-25-2021, 07:02 AM

|

#63

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,895

|

Quote: Quote:

Originally Posted by qwerty3656

The examples given are how holding total market plus 7-10% bonds blows away dividend growth investing. Nobody holds 7-10% bonds [after they retire].

|

Nobody? There's several posters here who are 100% equities, so clearly there would be more that are at 90/10 and above (or less, ref to bonds). You can probably find a poll on that here.

Seems like an odd (in addition to unfounded) response to the data.

OK, so 60/40 to 70/30 is probably more common here, and for retirees in general - you could make that change and report the data here. I'm confident that the dividend paying sector will lag.

Quote: Quote:

Originally Posted by RxMan

....

The best information Iíve come across regarding dividends and their impact on total returns is here:

https://www.hartfordfunds.com/dam/en...pers/WP106.pdf

There is some comparisons of dividend paying stocks verses the S&P 500 weighted index regarding total returns and beta. (See Figure 7 on Page 6 of this report)

I thought this information was relevant to this discussion. |

Caveat, I'm on my 1st cup of coffee, and I kind of skimmed the article, but WADR, I'm not sure (emphasis on *not* sure) it is relevant.

Figure 7 is interesting, and it does show some added performance for some of those dividend payer groups. But it seems they looked at the past 12 months of dividend performance to determine the groupings for the following 12 months. So does this mean an investor would need to review the dividend performance of all the S&P 500 stocks annually, and buy/sell to adjust their portfolio every year based on the past 12 months action? That sounds like a fair amount of work, with potential tax consequences.

What I do think is relevant is, if there is an advantage to div payers, why doesn't it show up in the charts of the div paying sector funds? That is really the only practical way for a retiree to easily obtain a decent level of diversification (though still less diversified than SPY or VTI). And those lag, quite significantly.

-ERD50

|

|

|

05-25-2021, 07:11 AM

05-25-2021, 07:11 AM

|

#64

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,895

|

Quote: Quote:

Originally Posted by olyveoil

So.

VTI beats Dividend paying funds in a large/long bull market.

Great. ...

|

The data says more than that, and I pointed it out.

The time frame is limited by the availability of data for these div-paying sector funds. They haven't been around long enough to get more data. I can't do anything about that.

And did you notice that the div payers under performed in the dips in that time frame? I don't think that bodes well for how they would do in other down turns. From that post:

Quote: Quote:

|

Look at that link. At the Feb 2009 trough, VTI held up better than the div payers. And again in the Jan-March 2020 drop, VTI held up better percentage-wise. And as you can see, VTI was already up considerably, so having a less deep correction is icing on the cake. All while providing 3.5% inflation adjusted withdrawals (income).

|

Quote: Quote:

Originally Posted by olyveoil

...

Again.......I am not an either/or investor. I think both have a place in my portfolio. I am accumulating for the long term future with income, dividend payers and growth/total market. ...

|

And I do exactly that - by buying VTI I get the div payers, the growth and total market. For the lowest effort, best tax scenario, greatest diversification and lowest fees - all in one-stop shopping. That's hard to beat, a win-win-win-win-win (as the data shows).

-ERD50

|

|

|

05-25-2021, 07:46 AM

05-25-2021, 07:46 AM

|

#65

|

|

Full time employment: Posting here.

Join Date: Nov 2020

Posts: 761

|

ERD50 - you have no interest in having a conversation about this - you are obsessed with proving the other guy wrong. I considered multiple investment options for the drawdown of my retirement assets. One was a 60/40 total market split, one was a 100% dividend growth split (which seems to have a similar return profile as the 60/40 split).

I get that you think the 60/40 split is less risky, but what I don't get is how you need to belittle anyone who takes a different view (e.g. that the future may be different than the past or that the dividend growth portfolio is just easier to manage, etc).

There is more than 1 answer here

|

|

|

05-25-2021, 08:08 AM

05-25-2021, 08:08 AM

|

#66

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,895

|

Quote: Quote:

Originally Posted by qwerty3656

ERD50 - you have no interest in having a conversation about this - you are obsessed with proving the other guy wrong. I considered multiple investment options for the drawdown of my retirement assets. One was a 60/40 total market split, one was a 100% dividend growth split (which seems to have a similar return profile as the 60/40 split).

I get that you think the 60/40 split is less risky, but what I don't get is how you need to belittle anyone who takes a different view (e.g. that the future may be different than the past or that the dividend growth portfolio is just easier to manage, etc).

There is more than 1 answer here

|

Where did I belittle anyone? I'm presenting data, it is what it is. How is that *not* a "conversation"?

But you are wrong. Don't argue with me, argue with the data. I think the expression is "Don't shoot the messenger"?

You say:

Quote: Quote:

|

One was a 60/40 total market split, one was a 100% dividend growth split (which seems to have a similar return profile as the 60/40 split).

|

So I ran VTI/Bonds 60/40 against the div-paying sector funds. Once again, the data shows that VTI/bonds outperforms 100% div sector funds/ETFs both in the long run and in the dips and in every metric (higher return, lower standard dev., less dip in a bad year). It is not similar.

See for yourself (blue line is VTI/bonds 60/40, red line is 7 div-paying sector funds/ETFs :

https://bit.ly/3fjN3il

Yes, I want to be right - I do that by reviewing the data. If the div sector looked better all around (including ease of investment), I'd be in it (but the advantage would likely get arbitraged out). If anything is wrong in my analysis, please, please point it out. I do not want to be under any false assumptions.

-ERD50

|

|

|

05-25-2021, 08:14 AM

05-25-2021, 08:14 AM

|

#67

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2011

Location: West of the Mississippi

Posts: 17,265

|

Quote: Quote:

Originally Posted by Out-to-Lunch

I agree 100%. There seems to be a cadre of people that have an emotional attachment to dividend-paying stocks. I am not sure why. I am glad that someone else has noticed this!

|

I believe it has something to do with the way the money arrives. Dividends arrive reliably, on a schedule that the investor can pretty much count on over long periods of time (Granted that could change in bad times.) Capital gains are often bumpy, up 20% this year, down 12% next year, and up 4% the year after that. Many people cannot handle the uncertainty. They sleep better with dividends just as many people sleep better knowing their 'financial advisor' is watching over their investments. (Personally, that would give me nightmares. )

__________________

Comparison is the thief of joy

The worst decisions are usually made in times of anger and impatience.

|

|

|

05-25-2021, 08:56 AM

05-25-2021, 08:56 AM

|

#68

|

|

Recycles dryer sheets

Join Date: May 2021

Location: Charleston

Posts: 105

|

Quote: Quote:

Originally Posted by ERD50

The data says more than that, and I pointed it out.

The time frame is limited by the availability of data for these div-paying sector funds. They haven't been around long enough to get more data. I can't do anything about that.

And did you notice that the div payers under performed in the dips in that time frame? I don't think that bodes well for how they would do in other down turns. From that post:

And I do exactly that - by buying VTI I get the div payers, the growth and total market. For the lowest effort, best tax scenario, greatest diversification and lowest fees - all in one-stop shopping. That's hard to beat, a win-win-win-win-win (as the data shows).

-ERD50

|

2007 - 2021 was an extended bull market. What else is there to know regarding the timeline? There are other dividend paying funds / etf's to choose from is there not?

What I did notice in the thread you copied were ignored counter-points.

I also noticed the post by RxMan that showed dividend payers outpaced in a down decade. Trying to think what dips there really were between 2007 and 2021 (2008 and subsequent recovery and the less than 6 month Corona virus dip in 2020)

What you do get with VTI and other dividend paying funds are more unknown dividend payments. Keep in mind the investing purpose for dividend payments. Regular income. That is not the purpose of VTI, nor of the other funds.

Feel free to keep VTI ad infinitum. I hope it works out for you.

BTW, happy 20th birthday to VTI earlier this week.

I happen to prescribe to bucketing. low risk income / dividend paying income / total return-growth. Want me to pick a good 12 year period to show 15%/25%/60% portfolio outperforming VTI where I can "only" choose certain time frames?

|

|

|

05-25-2021, 09:04 AM

05-25-2021, 09:04 AM

|

#69

|

|

Full time employment: Posting here.

Join Date: Oct 2020

Posts: 952

|

Quote: Quote:

Originally Posted by qwerty3656

The examples given are how holding total market plus 7-10% bonds blows away dividend growth investing. Nobody holds 7-10% bonds [after they retire].

|

Exactly.

Now I'm all for higher stock percentages than many people use. If dividend investing is effective as a mental trick for someone to hold a higher percentage stocks, it might work out really well for them. But they need to understand the risk characteristics of what they own, so they are not surprised in a downturn.

Maybe I misunderstood them, but some other people on this thread sounded like they thought a portfolio full of dividend stocks had risk characteristics similar to 60% VTI/40% bonds and that just doesn't hold up when looking at the data. High dividend stocks have only been slightly more resistant to downturns than VTI. Also, as you say, VTI has blown dividend shopping away, so there has been an empirical disadvantage to people generating cash via dividend distributions compared to managing for total returns and just selling as needed.

|

|

|

05-25-2021, 09:07 AM

05-25-2021, 09:07 AM

|

#70

|

|

Recycles dryer sheets

Join Date: May 2021

Location: Charleston

Posts: 105

|

Quote: Quote:

Originally Posted by Exchme

Exactly.

Now I'm all for higher stock percentages than many people use. If dividend investing is effective as a mental trick for someone to hold a higher percentage stocks, it might work out really well for them. But they need to understand the risk characteristics of what they own, so they are not surprised in a downturn.

Maybe I misunderstood them, but some other people on this thread sounded like they thought a portfolio full of dividend stocks had risk characteristics similar to 60% VTI/40% bonds and that just doesn't hold up when looking at the data. High dividend stocks have only been slightly more resistant to downturns than VTI. Also, as you say, VTI has blown dividend shopping away, so there has been an empirical disadvantage to people generating cash via dividend distributions compared to managing for total returns and just selling as needed.

|

1970's and 2000's were not that long ago.

|

|

|

05-25-2021, 09:27 AM

05-25-2021, 09:27 AM

|

#71

|

|

Full time employment: Posting here.

Join Date: Nov 2020

Posts: 761

|

Quote: Quote:

Originally Posted by ERD50

See for yourself (blue line is VTI/bonds 60/40, red line is 7 div-paying sector funds/ETFs :

https://bit.ly/3fjN3il

-ERD50 |

Take that same link and change the start year to 2009. You can create what ever answer you want.

I personally don't think Bonds or the NASDAQ are going to perform nearly as well over then next 10 years as they have over the last 10 years.

But I don't think I'm taking a big risk either way.

|

|

|

05-25-2021, 09:42 AM

05-25-2021, 09:42 AM

|

#72

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by qwerty3656

ERD50 - you have no interest in having a conversation about this - you are obsessed with proving the other guy wrong. ...

|

Quote: Quote:

Originally Posted by ERD50

... But you are wrong. Don't argue with me, argue with the data. ...

|

Quite funny actually. I have a leg in each camp. ERD50 can be quite excitable when the facts that he is offering are rejected by people who just don't want to listen.

There is really just one fact here: History predicts that a diversified equity tranche built with emphasis on dividends will underperform a broader diversified tranche that does not consider dividends as a selection criterion.

This is really not hard to understand. Selecting for dividends rejects: growth stocks which do not pay dividends, issuers who return profits to shareholders via stock buybacks, small stocks which rarely pay dividends, and value stocks, many of which do not pay dividends. This pretty much leaves old-line companies whose businesses do not offer attractive options for profit investment. But buy this napkin analysis or not, ERD50's fact is still a historical fact.

(There is a related fact that for most taxpayers, dividends are factually less tax-efficient than share buybacks. This seems to be increasingly understood but is probably out of scope for this thread.)

Quote: Quote:

Originally Posted by qwerty3656

...anyone who takes a different view (e.g. that the future may be different than the past or that the dividend growth portfolio is just easier to manage, etc). ...

|

Nothing wrong with any of that. Inductive reasoning is the best option we have, but no one can predict the future. There is an infinity of futures you can pick from. If your anticipated future includes massive growth in fish monger stocks, then that is where you will want to go. If you perceive a dividend portfolio as being easier to manage, then go for it. ERD50's point is that this will probably cost you in total return. Hopefully you realize that when you make your decision.

Other portfolio decisions, including fiddling AA, are out of scope versus the main point: History predicts that a diversified equity tranche built with emphasis on dividends will underperform a broader diversified tranche that does not consider dividends as a selection criterion.

You don't want to believe this, fine. But it is the relevant fact here.

__________________

Ignoramus et ignorabimus

|

|

|

05-25-2021, 10:20 AM

05-25-2021, 10:20 AM

|

#73

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,895

|

Quote: Quote:

Originally Posted by olyveoil

2007 - 2021 was an extended bull market. What else is there to know regarding the timeline? There are other dividend paying funds / etf's to choose from is there not? ...

|

I didn't choose that time-frame. It was based on looking for div-paying funds/ETFs that had some history. Those were the seven that I found with the longest history, and that dictated the time-frame.

Please find some others for me with an equal or greater history, I'd be interested in adding them to the list.

And I've already pointed out (twice now) what else is there to know regarding the timeline - there were dips, and those div sectors under-performed. The div folks keep telling me that the div sector holds up in dips. How come we don't see it?

Quote: Quote:

Originally Posted by olyveoil

...

What I did notice in the thread you copied were ignored counter-points.

I also noticed the post by RxMan that showed dividend payers outpaced in a down decade. ....

|

Please point out any counter-points I missed. I did see one, but then noticed that someone else responded. They covered it as well/better than I would have, so it was answered, no need for me to replicate it.

And as I mentioned, it appears that it would take a *lot* of effort (and probably taxes from trading) to duplicate that study. If it was easy, why don't these div sector funds show this performance boost? That is where the rubber meets the road.

Quote: Quote:

Originally Posted by olyveoil

... What you do get with VTI and other dividend paying funds are more unknown dividend payments. Keep in mind the investing purpose for dividend payments. Regular income. That is not the purpose of VTI, nor of the other funds.

...

|

I don't see the point. Money is fungible. As long as my portfolio is returning value, it makes no difference (other than taxes, which favor a non-zero cost basis sale) if it is from divs or a combination of divs and growth (like VTI).

All I need for a steady income from VTI is to look at my divs once a year, and sell off enough to make up any delta between my annual expenses and those divs. Easy-peasy.

Dividend income is no simpler to deal with, and maybe more complex. If you spend less than divs, you need to go re-invest it. If you spend more than divs, you still need to do a sale. Sure, you could let the excess sit in cash until you need it, but that's gonna be a drag on performance. Seems highly unlikely that one's personal spending habits match exactly the div payouts, unless you want to let someone else dictate what you spend. No thanks.

Quote: Quote:

Originally Posted by olyveoil

... Want me to pick a good 12 year period to show 15%/25%/60% portfolio outperforming VTI where I can "only" choose certain time frames?

|

Quote: Quote:

Originally Posted by qwerty3656

Take that same link and change the start year to 2009. You can create what ever answer you want. ....

|

Not interested in cherry-picked time frames. I could easily counter with cherry-picked times showing the opposite. No value to it. No thanks. Again, find some high-div sector funds with a longer history, I might have missed some. I'll be glad to take a look.

Quote: Quote:

Originally Posted by qwerty3656

... I personally don't think Bonds or the NASDAQ are going to perform nearly as well over then next 10 years as they have over the last 10 years.

But I don't think I'm taking a big risk either way.

|

Could very well be. But I see no reason to think that the div sector would do better than the equivalent risk Total-Market/Bond portfolio. Do you?

I never said you are taking a big risk. I demonstrated with data that these div paying sector funds do not deliver what the fans of them claim. They under-perform over the long run, they don't hold up better in the dips in their history, and they are less tax efficient.

But there certainly is risk to having $500,000 less in your portfolio that started with $1M in 2007, and that's where the div-sector investor would be. An extra 1/2 Million covers a lot of any future relative under-performance (if that even happens)

-ERD50

|

|

|

05-25-2021, 11:14 AM

05-25-2021, 11:14 AM

|

#74

|

|

Recycles dryer sheets

Join Date: Jul 2018

Posts: 329

|

Quote: Quote:

Originally Posted by Bossman

My thanks to every ones input with extra kudos going to ERD50 for his detailed analysis. For those who are curious as to my final decision, I decided to invest 49% in monthly dividend ETFs (PGX and SPHD) and 49% in a total return ETF (VTI). The remaining 2% will be in cash to provide a cushion for monthly disbursements.

|

Please let us know how it works out. I have a good chunk in SPHD and its paying about 4% each month. SPHD lost about 25% a while back and the monthly dividend just kept coming.

|

|

|

05-25-2021, 12:12 PM

05-25-2021, 12:12 PM

|

#75

|

|

Recycles dryer sheets

Join Date: May 2021

Location: Charleston

Posts: 105

|

Quote: Quote:

Originally Posted by ERD50

I didn't choose that time-frame. It was based on looking for div-paying funds/ETFs that had some history. Those were the seven that I found with the longest history, and that dictated the time-frame.

-ERD50

|

Of course you chose the time frame. Absurd to suggest you didn't. How did the charts get on this forum if you didn't pick the input data?

|

|

|

05-25-2021, 12:38 PM

05-25-2021, 12:38 PM

|

#76

|

|

Full time employment: Posting here.

Join Date: Oct 2020

Posts: 952

|

Quote: Quote:

Originally Posted by qwerty3656

Take that same link and change the start year to 2009. You can create what ever answer you want.

I personally don't think Bonds or the NASDAQ are going to perform nearly as well over then next 10 years as they have over the last 10 years.

But I don't think I'm taking a big risk either way.

|

Uh, 2009 would miss the first half of the Great Financial Crisis, so is a peculiar choice. My numbers used the full range of the VYM data and it happily caught both a bad fall in 08-09 and a large bull market since. However, I love to learn and thought maybe you'd done an analysis, so I went and looked.

From the start of 2009, the same 93% VTI/7% bond has smaller drawdown to the bottom of the GFC (-20% vs -25% for VYM) and 93% VTI also much better performance since, with higher ending balances and higher Sharpe and Sortino ratios than VYM. So for your hand picked start date, I found exactly the same thing as before - dividend stocks did not protect on the downside and did not keep up on the upswing.

I do not understand your portfolio recommendation. If you are advocating for reducing bond percentages because you get income from dividends, the data refutes that idea. Dividend stocks fall like other stocks in downturns so are way riskier than bonds. Look elsewhere for shelter in a storm.

If you are you advocating dividend stocks to replace the stock portion of your portfolio, that would be an odd expectation. I'm not real up on literature, but I don't think factor based research identified dividends as a factor that could be added to enhance total return.

In any case, I'll do me and you do you.

|

|

|

05-25-2021, 12:51 PM

05-25-2021, 12:51 PM

|

#77

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by Exchme

... I don't think factor based research identified dividends as a factor that could be added to enhance total return. ...

|

Markowitz's Capital Asset Pricing Model (CAPM) considered only beta as a factor. Fama and French's Three Factor Model added small stock and value stocks as enhancements to return. Interestingly, those two factors are ones that selecting based on dividends will de-emphasize. Their later five-factor model added profitability and investment. Again, dividend orientation misses the prize, as dollars disbursed as dividends are not available for investment. There is some question whether the five-factor model is an improvement, though. But regardless you are correct, "dividends" does not appear in any of the models. If anything, IMO, dividends will probably be negatively correlated with high potential future value of a company.

__________________

Ignoramus et ignorabimus

|

|

|

05-25-2021, 01:00 PM

05-25-2021, 01:00 PM

|

#78

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,895

|

Quote: Quote:

Originally Posted by olyveoil

Of course you chose the time frame. Absurd to suggest you didn't. How did the charts get on this forum if you didn't pick the input data?

|

It is not absurd at all. I did not choose the time frame. REPEAT: I did not choose the time frame.

I entered that list of div-paying sector funds/ETFs that I could find with the longest history. I entered them in that web page, and then... the web page chose the time frames based on the history of those funds.

Look at the web page yourself. The time-frame I chose is 1985 to current. The web page reports:

Quote: Quote:

|

Note: The time period was constrained by the available data for iShares International Select Div ETF (IDV) [Jul 2007 - Apr 2021].

|

I'll ask again, can you give me some available div-focused funds/ETFs with a longer history? I'll gladly run the data on them.

-ERD50

|

|

|

05-25-2021, 01:23 PM

05-25-2021, 01:23 PM

|

#79

|

|

Recycles dryer sheets

Join Date: May 2021

Location: Charleston

Posts: 105

|

Quote: Quote:

Originally Posted by ERD50

It is not absurd at all. I did not choose the time frame. REPEAT: I did not choose the time frame.

I entered that list of div-paying sector funds/ETFs that I could find with the longest history. I entered them in that web page, and then... the web page chose the time frames based on the history of those funds.

Look at the web page yourself. The time-frame I chose is 1985 to current. The web page reports:

I'll ask again, can you give me some available div-focused funds/ETFs with a longer history? I'll gladly run the data on them.

-ERD50

|

Your chart / your time frame. Simple as that. Gotta love someone blaming chart output on the "website".

|

|

|

05-25-2021, 01:36 PM

05-25-2021, 01:36 PM

|

#80

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by olyveoil

Your chart / your time frame. Simple as that. Gotta love someone blaming chart output on the "website".

|

If you understood how PV works, you would understand ERD50's answers, which are quite a bit more polite than yours. I fail to see how your post here moves the dialog along in any useful way.

__________________

Ignoramus et ignorabimus

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|