PERSonalTime

Recycles dryer sheets

- Joined

- Jan 19, 2014

- Messages

- 456

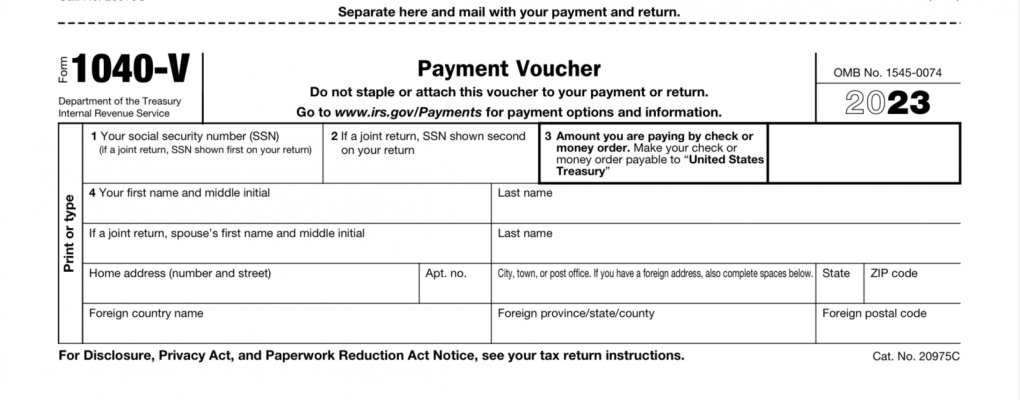

I just did my income taxes and I discovered that I will owe money on this years return. Is it possible to file my income tax return now in March and make the payment of tax due anytime on or before April 15? Or am I required to submit the payment of tax due at the time I file my income tax return?