Graybeard

Full time employment: Posting here.

- Joined

- Aug 7, 2018

- Messages

- 597

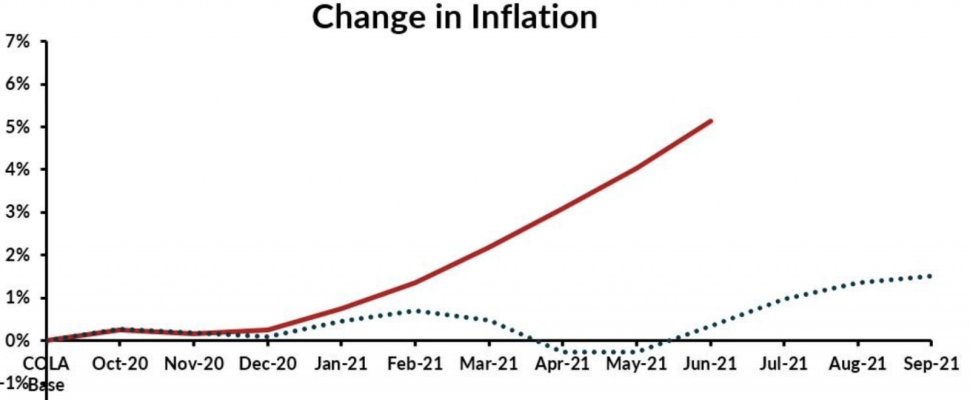

I saw this reported on CNBC today. I was shocked at the percentage but I guess this is just a guess right now. They discussed changing the way SS COLA is determined because the inflation factors they use are not the things that seniors buy the most. For example, healthcare is excluded but energy is included.

"The Social Security cost-of-living adjustment for 2022 could be 6.1% due to inflation, according to a new estimate.

That would be the biggest increase since 1983, according to non-partisan advocacy group The Senior Citizens League, which calculated the figure. It’s also a bump up from last month’s estimate, when the increase for next year was expected to be 5.3%."

https://www.cnbc.com/2021/07/14/social-security-cost-of-living-increase-for-2022-may-be-largest-in-decades.html

"The Social Security cost-of-living adjustment for 2022 could be 6.1% due to inflation, according to a new estimate.

That would be the biggest increase since 1983, according to non-partisan advocacy group The Senior Citizens League, which calculated the figure. It’s also a bump up from last month’s estimate, when the increase for next year was expected to be 5.3%."

https://www.cnbc.com/2021/07/14/social-security-cost-of-living-increase-for-2022-may-be-largest-in-decades.html