I read this click-bait article in MW, which referenced a click-bait article on CNN. I know. I shouldn't let click bait suck me in. But it got me thinking.

To summarize, CNN's fluff piece was about inflation. They interviewed a couple who complained about a huge (if unsubstantiated) increase in milk prices. Their anecdotal experience with inflation was vastly worse than the official inflation rate "of around 5% over the past year."

Of course there was some sensationalism involved, but my experience is closer to theirs than the official rate. I do a bit of mental arithmetic when I'm in a store lately and it seems most things I buy or have bought are up 20%-40%. I'm not even looking at things like vehicles or houses, or products experiencing temporary shortages.

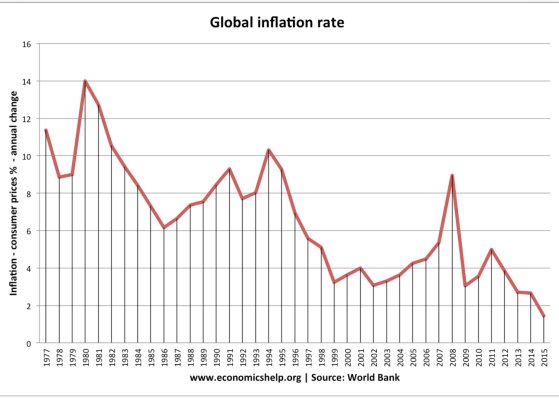

Is there a more accurate number somewhere, or do we just have to wait for the next annual update? It seems to me this is the worst round of inflation I can recall, at least if it continues at this rate. Everything went up so quickly!

To summarize, CNN's fluff piece was about inflation. They interviewed a couple who complained about a huge (if unsubstantiated) increase in milk prices. Their anecdotal experience with inflation was vastly worse than the official inflation rate "of around 5% over the past year."

Of course there was some sensationalism involved, but my experience is closer to theirs than the official rate. I do a bit of mental arithmetic when I'm in a store lately and it seems most things I buy or have bought are up 20%-40%. I'm not even looking at things like vehicles or houses, or products experiencing temporary shortages.

Is there a more accurate number somewhere, or do we just have to wait for the next annual update? It seems to me this is the worst round of inflation I can recall, at least if it continues at this rate. Everything went up so quickly!

. But I am pretty sure we paid about $0.69/lb last year.

. But I am pretty sure we paid about $0.69/lb last year.