DaveLeeNC

Recycles dryer sheets

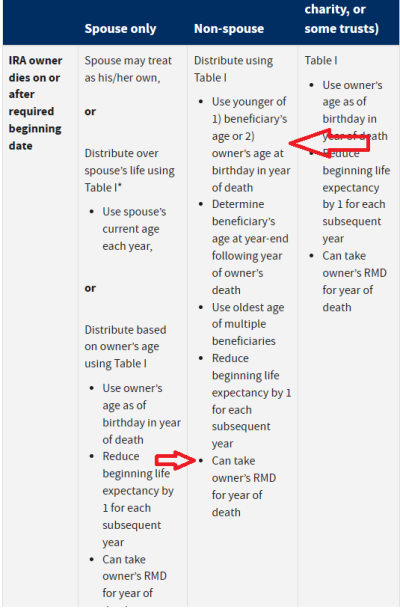

The situation is an IRA where the owner died in May 2022 (before taking her RMD). There were 7 beneficiaries and the account transfers are complete.

I don't know why I thought this but I was under the impression that one (or more) of us must make a withdrawal equal to (or greater than) the RMD amount of the original owner during 2022. One of the siblings (I know - a bit late now) is questioning this.

So what exactly are the requirements to meet the original owner's RMD requirements for 2022? Is it really distributed among the seven beneficiaries? That seems extreme (and a bit late to figure this out, I guess). My research has left me unclear on this.

Thanks.

dave

ps. I think that I understand the convoluted rules for 2023 and beyond, but not sure about 2022.

I don't know why I thought this but I was under the impression that one (or more) of us must make a withdrawal equal to (or greater than) the RMD amount of the original owner during 2022. One of the siblings (I know - a bit late now) is questioning this.

So what exactly are the requirements to meet the original owner's RMD requirements for 2022? Is it really distributed among the seven beneficiaries? That seems extreme (and a bit late to figure this out, I guess). My research has left me unclear on this.

Thanks.

dave

ps. I think that I understand the convoluted rules for 2023 and beyond, but not sure about 2022.