You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

International has been a real disappointment

- Thread starter MrLoco

- Start date

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

I continue to hold VXUS as core holding and the ratio is about 15-16 percent of portfolio (was as much as 20 percent but has pretty much sucked the last two years).

I do believe international will have a golden age during the next decade with China and India driving momentum along with a recovering eurozone.

A value investor would be accumulating more at this stage but I'm ok where I am.

I do believe international will have a golden age during the next decade with China and India driving momentum along with a recovering eurozone.

A value investor would be accumulating more at this stage but I'm ok where I am.

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

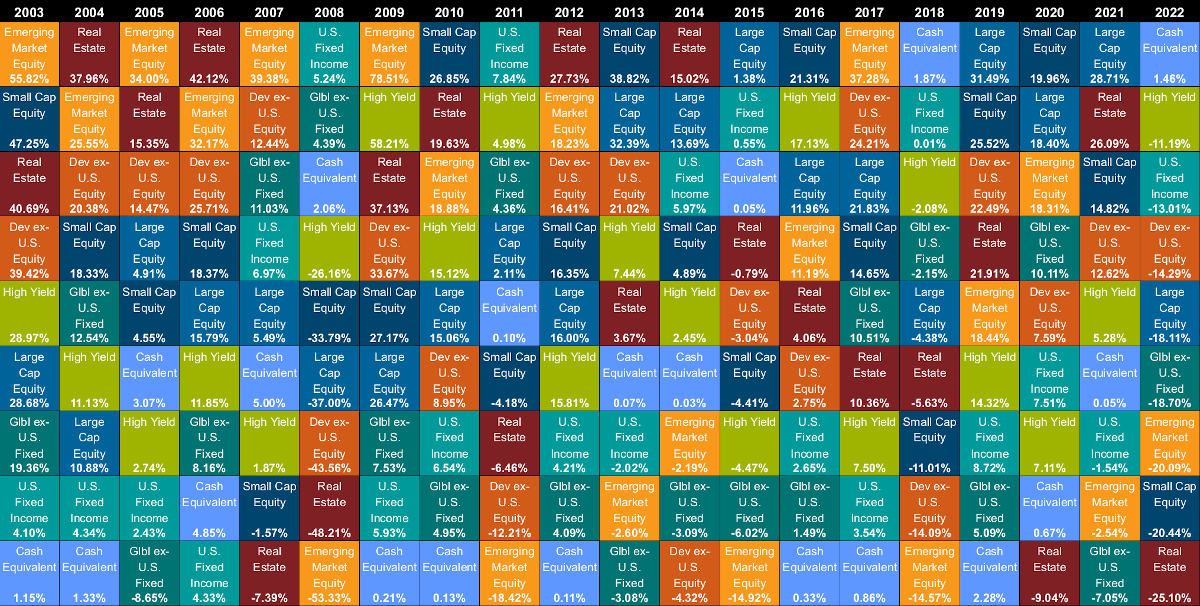

In 15 of 20 years in the returns chart, Orange is either first or last. I'd say some might be better off with less Orange in their Port.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In 15 of 20 years in the returns chart, Orange is either first or last. I'd say some might be better off with less Orange in their Port.

Well, orange is emerging markets which is an extremely volatile asset class, so seeing it at the top or bottom isn't surprising.

The gray - msci eafe - is international, more developed countries. That's not nearly as volatile.

If you rebalance, volatility between asset classes is a good thing.

Thank you very much for the chart Audrey. It looks like 13/20 years would have been tops with just S&P 500 Growth and MSCI Emerging Market Shares, add a dollop of Russell 2000 Value and one is set. Too bad no guarantees the future will look like the past...Yes - I see things differently. International has outperformed in the past, and will again sometime in the future. I don't know when, so I just stay fully invested.

I believe diversification improves long term risk-adjusted performance, so I'm sticking with my allocation.

International can go through long periods of underperforming, but also long periods of outperforming, and you never know when. This table gives a good historical perspective on asset classes and relative performance.

And, actually, the international funds I added to after 2014 (pretty much MSCI EAFE class - I don't mess with emerging markets), because they were down, outperformed the rest of my portfolio in 2015.

- Joined

- Apr 14, 2006

- Messages

- 23,057

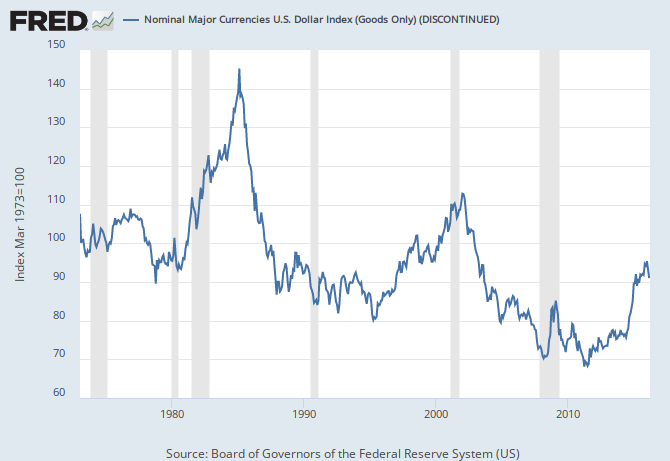

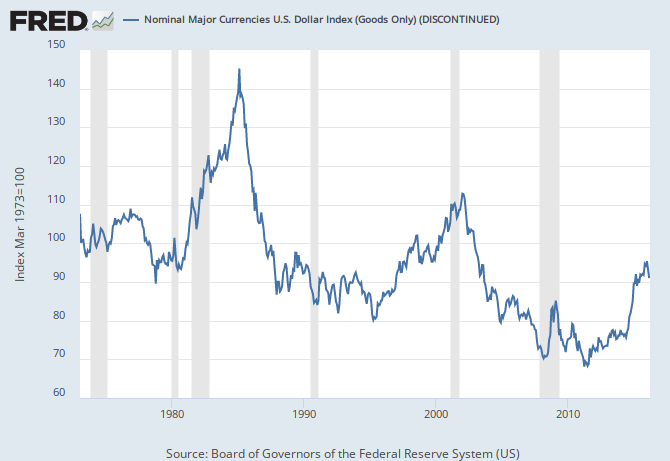

Some think the dollar is set for a decline, which might bode well for international equities.

Is the sun setting on the dollar rally?

Is the sun setting on the dollar rally?

ziggy29

Moderator Emeritus

It's been brutal -- recently international (especially emerging markets) have been a boat anchor. But unless you believe trees grow to the sky, the rally in the dollar can't last forever, and when the rally ends and the dollar mean-reverts, it will be a different story.

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

Capital flows to emerging markets surge to 21-month high http://www.cnbc.com/id/103505079

http://www.cnbc.com/id/103505079

Global emerging markets (EMs) cinched foreign portfolio inflows of $36.8 billion in March, the strongest month since June 2014, with Asia leading the way, according to the Institute of International Finance (IIF).

But March's strong EM performance may just be a one-off, the IIF warned.

"Going forward, the going could get a bit rougher, as markets have taken a breather in recent days, in part because Fed officials have struck a less dovish tone in recent speeches, and as valuations are no longer so attractive."

The International Monetary Fund (IMF) issued a bleak outlook ahead for EMs in a new research paper this month, warning that some EM economies may face significant financing gaps in times of crisis.

http://www.cnbc.com/id/103505079

Global emerging markets (EMs) cinched foreign portfolio inflows of $36.8 billion in March, the strongest month since June 2014, with Asia leading the way, according to the Institute of International Finance (IIF).

But March's strong EM performance may just be a one-off, the IIF warned.

"Going forward, the going could get a bit rougher, as markets have taken a breather in recent days, in part because Fed officials have struck a less dovish tone in recent speeches, and as valuations are no longer so attractive."

The International Monetary Fund (IMF) issued a bleak outlook ahead for EMs in a new research paper this month, warning that some EM economies may face significant financing gaps in times of crisis.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

It's been brutal -- recently international (especially emerging markets) have been a boat anchor. But unless you believe trees grow to the sky, the rally in the dollar can't last forever, and when the rally ends and the dollar mean-reverts, it will be a different story.

And if you take a longer view, the secular trend for the dollar is lower. The most recent dollar rally isn't nearly as strong as the one in the early 80's or late 90's. And each successive low after those rallies bottomed out lower than the one before.

With the U.S. continuing to run structural trade deficits, there's good reason to think that long-term downward trend for the Dollar will continue as well.

Last edited:

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Recently (say since late January), emerging markets have gone up more than 20%. Maybe when the gains go above 30%, it might be time to start taking some money off of that table.

If you were lucky enough to buy at those Jan lows that would be a good trade. But the EM index is only now back to where it was last Dec, and it's still 20% below where it was last April. Plenty of bottom fishers are still underwater.

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Cost of diversification and a good buying opportunity.

Here is a very easy to read article by Ben Carlson (A Wealth of Common Sense) about European Markets Are European Stocks Cheap or is the U.S. Expensive?

His summary

His summary

[FONT="]To recap: [/FONT]

- [FONT="]European equities trade at a huge valuation discount to the U.S. [/FONT]

- [FONT="]European equities have underperformed at a historical rate over the past five years. [/FONT]

- [FONT="]European equities currently sport a 1.2% advantage in terms of dividend yields. [/FONT]

- [FONT="]This information won't matter until it matters as fundamentals in the stock market require patience and don't work on a set schedule.[/FONT]

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Somebody has to get lucky, so it might as well be me.If you were lucky enough to buy at those Jan lows that would be a good trade. But the EM index is only now back to where it was last Dec, and it's still 20% below where it was last April. Plenty of bottom fishers are still underwater.

And if you take a longer view, the secular trend for the dollar is lower.

It should be if monetary policies of the Fed and Eurozone stay on course. If I recall correctly the Fed wants to average between 2% and 3% inflation while the ECB wants to be "close to, but below 2%".

Assuming both stick to that and actually deliver, the dollar will have to drop, no?

All things considered equal (which they aren't

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

And if you take a longer view, the secular trend for the dollar is lower. The most recent dollar rally isn't nearly as strong as the one in the early 80's or late 90's. And each successive low after those rallies bottomed out lower than the one before.

With the U.S. continuing to run structural trade deficits, there's good reason to think that long-term downward trend for the Dollar will continue as well.

Multiple choice test here, pick one

1) There is a clear trend line down if we do a linear regression fit.

2) The US dollar is just a bit under where it was in the 1970's. Just returning to it's natural place in the universe of currencies.

3) This past data in this chart doesn't tell us where we are going in the future.

4) None of the above.

Regarding international, FWIW I tend to go with a momentum approach so have some in small cap international and none in international large cap.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

It should be if monetary policies of the Fed and Eurozone stay on course. If I recall correctly the Fed wants to average between 2% and 3% inflation while the ECB wants to be "close to, but below 2%".

The Fed has an explicit target of 2% while the ECB's language is, as you say, for inflation below, but close to, 2%. I'd say they're essentially the same.

The big difference right now is that the ECB is massively undershooting it's inflation target whereas the Fed looks like it could finally get inflation of 2%. That means higher rates in the U.S. and lower rates in Euroland. And that should be good for the $ vs. the Euro.

Of course all of this is pretty well factored in to existing exchange rates, which is why we just saw the dollar fall on Yellen's comments suggesting the Fed won't raise rates in April.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Multiple choice test here, pick one:

1) There is a clear trend line down if we do a linear regression fit.

2) The US dollar is just a bit under where it was in the 1970's. Just returning to it's natural place in the universe of currencies.

3) This past data in this chart doesn't tell us where we are going in the future.

4) None of the above.

I'll choose #1, and here's why:

Economic theory says that when you run a trade deficit one of two things happens. Either your currency falls relative to your trading partners. Or your trading partners stabilize the exchange rate by buying your currency with the cash they've earned through trade.

In practice, both of those things have happened. Trading partners like China have bought massive amounts of USD reserves to prevent their currency from rising. But they still haven't bought enough to completely stabilize the exchange rate. And other trading partners like Europe don't do this at all. So, on balance, you expect out currency to fall.

Now the U.S. has run a trade deficit pretty much consistently since the Bretton Wood's international monetary system fell apart in the early 70's. Which pretty much explains the long-term downward trend since then.

And because the U.S. continues to run trade deficits, we can expect the dollar to continue a downward trend until something changes.

Last edited:

I choose #5. Economists and their theories can help explain (sort-of) why exchange rates (of strong currencies) are where they are, but aren't good at all for predicting where they will be at any time in the future.Multiple choice test here, pick one:

1) There is a clear trend line down if we do a linear regression fit.

2) The US dollar is just a bit under where it was in the 1970's. Just returning to it's natural place in the universe of currencies.

3) This past data in this chart doesn't tell us where we are going in the future.

4) None of the above.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

I choose #5. Economists and their theories can help explain (sort-of) why exchange rates (of strong currencies) are where they are, but aren't good at all for predicting where they will be at any time in the future.

Agree. That USD chart covers a multi-generational time span. I wouldn't use anything I said to suggest that one can time currency trades.

But because I'm investing for a period as long as 60 years, I feel pretty good in saying that I have a better chance of seeing new U.S. dollar lows on that chart than seeing new highs.

Senator

Thinks s/he gets paid by the post

I'll choose #1, and here's why:

Economic theory says that when you run a trade deficit one of two things happens. Either your currency falls relative to your trading partners. Or your trading partners stabilize the exchange rate by buying your currency with the cash they've earned through trade.

In practice, both of those things have happened. Trading partners like China have bought massive amounts of USD reserves to prevent their currency from rising. But they still haven't bought enough to completely stabilize the exchange rate. And other trading partners like Europe don't do this at all. So, on balance, you expect out currency to fall.

Now the U.S. has run a trade deficit pretty much consistently since the Bretton Wood's international monetary system fell apart in the early 70's. Which pretty much explains the long-term downward trend since then.

And because the U.S. continues to run trade deficits, we can expect the dollar to continue a downward trend until something changes.

With China's trade surplus, they receive USD. They either buy treasuries, gold, oil, or hotels. They do not need to buy anymore USD, they have a surplus. They do not need to buy USD to trade with us. All other countries take their surplus USD.

The Dollar will get stronger, if and when they raise rates. It really is that simple. Nowhere else can you get the stability and a return that the USD has.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That multiple choice quiz is perhaps interesting to ponder. I'm sure Gone4Good and others have better answers then I would come up with.

Now the real issue I think is what does one do with international stock investing. The currency component is only one variable.

So my strategy is to split the internationals: 40% to large cap (LCI), 60% to small cap (SCI). That is after allocating equities to 60/40, US/International. It seems the best returns are from SCI. LCI is appears to be better correlated with large cap US then SCI is with small cap US. I think SCI is really only about 15% of international equity so I'm very much over weighting SCI.

Now the real issue I think is what does one do with international stock investing. The currency component is only one variable.

So my strategy is to split the internationals: 40% to large cap (LCI), 60% to small cap (SCI). That is after allocating equities to 60/40, US/International. It seems the best returns are from SCI. LCI is appears to be better correlated with large cap US then SCI is with small cap US. I think SCI is really only about 15% of international equity so I'm very much over weighting SCI.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

With China's trade surplus, they receive USD. They either buy treasuries, gold, oil, or hotels. They do not need to buy anymore USD, they have a surplus. They do not need to buy USD to trade with us. All other countries take their surplus USD.

China has two general choices with the USD they receive in trade. They can keep those USD out of circulation by buying US assets (treasuries, US hotels, etc). Or they can release those dollars on the market by exchanging them for other non-us assets (gold, oil, internal investments, etc.)

If they choose the former, they neutralize the trade imbalance's impact on the exchange rate. If they do the later, they effectively sell dollars to buy other stuff and that selling puts downward pressure on the currency.

The Dollar will get stronger, if and when they raise rates. It really is that simple. Nowhere else can you get the stability and a return that the USD has.

I'm talking more secular trends than cyclical.

But I wouldn't be too sure Fed increases will cause a USD rally from where we are. The market currently has a bunch of Fed rate hikes already priced in. The Euro hit a low of about 1.06 to the USD in November right before the first Fed increase. The Euro's up about 6.6% since then even with the Fed raising rates in December.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Yes, I have quite a bit of international equities, even EM, and have been suffering their low return relative to the S&P. But they have been leading for the last 30 days. Will see how long this trend last. I have been patient for the last 2 years, and am not giving up now.

I thought that the late Templeton was a pioneer in international investing, and he founded several globally diversified MFs.

.... John Templeton and John Greaney have both opined that there is no reason to invest outside the USA. Maybe they are right...

I thought that the late Templeton was a pioneer in international investing, and he founded several globally diversified MFs.

Similar threads

- Replies

- 24

- Views

- 4K

- Replies

- 22

- Views

- 3K