hopefullyoneday

Recycles dryer sheets

- Joined

- Dec 2, 2017

- Messages

- 247

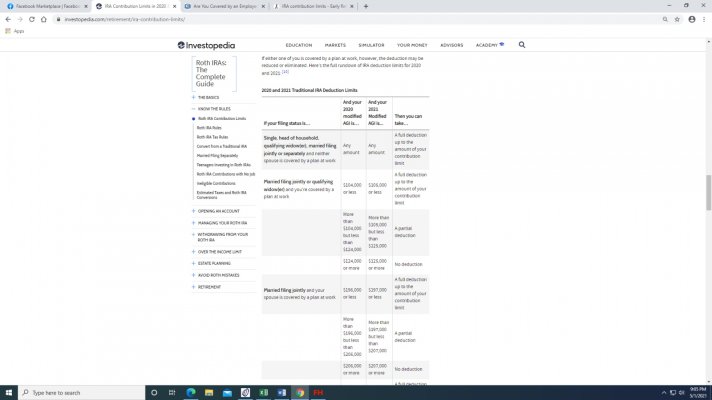

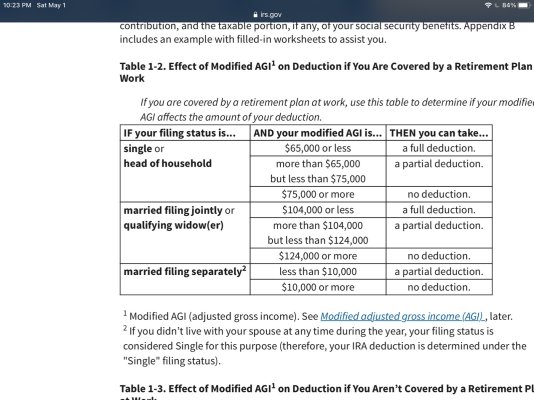

I have a question about IRA income limits for contributing to a IRA. Just got my taxes back from my tax guy and he told me i had to re-character my TRAD IRA to a ROTH IRA. He said my wife and i made too much money. I am a little confused when i looked at the TRADITIONAL IRA contributions limit table. I think my wife and i fall under the married filing jointly but there is 2 sections, 1 for if i am covered by a plan at work and another section if my spouse is covered by a plan at work. I have a pensions which is classified as a defined benefit plan and i also have a 457b plan offered thru my work. My spouse has a 401k plan as well as a pension plan. our combined AGI is $127k and my tax guy says we dont qualify for a Tradional IRA. I thought both of our plans were considered as a covered by work plan, or am i wrong. Thanks for any help.