Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

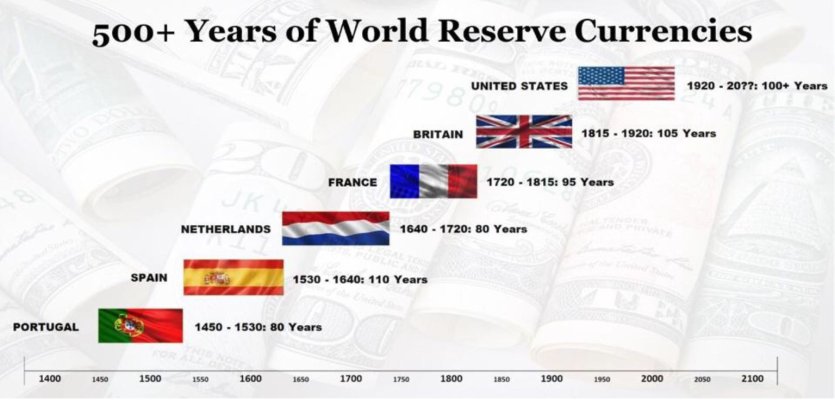

Are there concerns about the US economy, dollar, and economic policies, of course there are. But what would you own if not dollars? Gold? Sorry, I know there are plenty of gold bugs but gold bullion would be useless in a serious crisis and collectible coins are simple ripoffs and scams. Euros? GBP? They are closer and more exposed economically to the first threat the guy mentions (Ukraine war). Maybe Yen? Renminbi?

I'll keep my money in US dollars thank you!

I don't know much about international economic policies, but SOMEBODY thinks it's good to own more gold - namely China who has been buying - again.

No, probably not going back to a gold standard. I assume we're past that. But the stabilizing effect of gold in their treasury AND considering it more advantageous than more green backs may be instructive - not that I could explain why.