|

|

07-02-2014, 12:26 PM

07-02-2014, 12:26 PM

|

#61

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Why? There are a lot of people here with more money than I have, I am sure.

My portfolio just happens to be more volatile. I like to live dangerously.

By the way, top of market to the next bottom, I have not "lost" $1M, but far more than $500K. It hurt like crazy to see that money go, but I kept telling myself it was the house money. I've got to keep on playin'.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

07-02-2014, 12:36 PM

07-02-2014, 12:36 PM

|

#62

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,731

|

Quote: Quote:

Originally Posted by REWahoo

I knew you were a player but until now didn't realize what league you were in. Impressive.

|

Wow! Maybe an upcoming spot on CNBC's Fast Money show in the works  ?

|

|

|

07-02-2014, 12:40 PM

07-02-2014, 12:40 PM

|

#63

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Nah, these guys are multi-decamillionaires, while I may never see that 8th figure.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

07-02-2014, 12:41 PM

07-02-2014, 12:41 PM

|

#64

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

You're in trouble now NW-B. We'll be watching you more carefully.

|

|

|

07-02-2014, 12:46 PM

07-02-2014, 12:46 PM

|

#65

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by NW-Bound

Nah, these guys are multi-decamillionaires, while I may never see that 8th figure.

|

You need an attitude adjustment. Try to be more positive!

__________________

Numbers is hard

|

|

|

07-02-2014, 12:48 PM

07-02-2014, 12:48 PM

|

#66

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

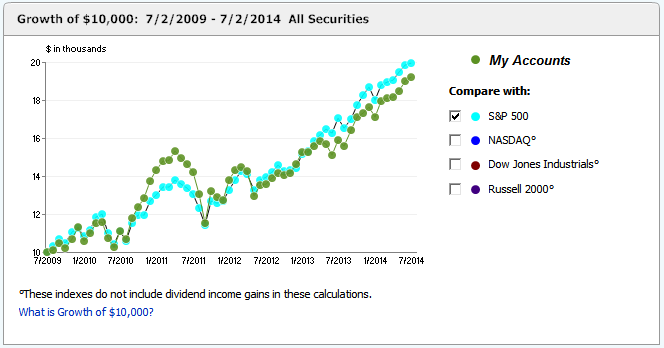

Why? To see my "moves"?  I have not been doing that well since mid 2011.

I repeatedly called "buy, buy, buy" at the market bottom in March 2009, and the posts are still there in the archive. I bought foreign and basic material stocks which beat the pants off S&P in 2009 till mid 2011. Then, they stumbled and I have lost ground since.

Here. Let me show it to you. Hold on.

This Quicken chart shows what I was talking about, when I said I beat the S&P in early 2011, but then gave up that gain. I did not trade often enough. Since then, the S&P has been beating me. However, I am only 70% in the market, with only 5% bond and 25% cash which did little to help.

Note that the plot of the S&P does not include dividend, but my plot is after WR, which is higher than the S&P dividend. So, I am doing OK, but not great.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

07-02-2014, 01:46 PM

07-02-2014, 01:46 PM

|

#67

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2005

Posts: 4,366

|

Quote: Quote:

Originally Posted by NW-Bound

Why? To see my "moves"?  I have not been doing that well since mid 2011.

I repeatedly called "buy, buy, buy" at the market bottom in March 2009, and the posts are still there in the archive. I bought foreign and basic material stocks which beat the pants off S&P in 2009 till mid 2011. Then, they stumbled and I have lost ground since.

Here. Let me show it to you. Hold on.

This Quicken chart shows what I was talking about, when I said I beat the S&P in early 2011, but then gave up that gain. I did not trade often enough. Since then, the S&P has been beating me. However, I am only 70% in the market, with only 5% bond and 25% cash which did little to help.

Note that the plot of the S&P does not include dividend, but my plot is after WR, which is higher than the S&P dividend. So, I am doing OK, but not great.

|

The S&P 500 is the one benchmark Quicken shows that does include dividends. No footnote mark on it.

|

|

|

07-02-2014, 01:48 PM

07-02-2014, 01:48 PM

|

#68

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by NW-Bound

...

This Quicken chart shows what I was talking about, when I said I beat the S&P in early 2011, but then gave up that gain. I did not trade often enough. Since then, the S&P has been beating me. However, I am only 70% in the market, with only 5% bond and 25% cash which did little to help.

...

|

Hmm ... he doth protest too much, methinks.

That is a weird way to benchmark if I'm understanding you. Comparing a 100% equity versus a balanced portfolio less withdrawals? Still I'm guessing you did quite well, nice going NWB.

For myself, over the last few years I've compared my portfolio to (1) an index based portfolio, (2) a Wellington based portfolio. Both of these benchmarks include some fixed income components that realistically have to be kept -- ibonds, cash, short term bonds.

|

|

|

07-02-2014, 03:49 PM

07-02-2014, 03:49 PM

|

#69

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by Animorph

The S&P 500 is the one benchmark Quicken shows that does include dividends. No footnote mark on it.

|

Thanks. I never noticed that.

Quote: Quote:

Originally Posted by Lsbcal

Hmm ... he doth protest too much, methinks.

That is a weird way to benchmark if I'm understanding you. Comparing a 100% equity versus a balanced portfolio less withdrawals? |

I do not want to make it too easy on myself. Why be an active investor just to match the S&P?  Well, if I just match it on the way up, but lose less than it does on the way down, I am happy too.

And well, my portfolio is not really balanced, as I have not spent that much time studying bonds, and felt more comfortable with cash.

Quote: Quote:

|

For myself, over the last few years I've compared my portfolio to (1) an index based portfolio, (2) a Wellington based portfolio.

|

I have been eyeing some balanced funds, with the idea of retiring from active investing and trusting them with my money. One of these days, but not yet...

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

07-02-2014, 03:59 PM

07-02-2014, 03:59 PM

|

#70

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by NW-Bound

...(snip)...

I have been eyeing some balanced funds, with the idea of retiring from active investing and trusting them with my money. One of these days, but not yet...

|

I feel the same way. Part of the reason I mentioned getting a well thought out benchmark portfolio together is to watch it over several years. I usually check things at the end of each quarter and have done this for about 3.5 years now.

I'm impressed that these benchmark portfolios are not that far off and sometimes beat my brilliant portfolio. Tends to humble one.

|

|

|

07-02-2014, 04:28 PM

07-02-2014, 04:28 PM

|

#71

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

I have had the potential to "win" 6, 7 figures in the market but have always chickened out and sold early.

Recently I was in Gilead call options when it dipped down to $65 a few weeks back. I loaded up on August $70 calls dirt cheap but sold them much too early. I made $20,000 but today they are worth $600,000.

|

|

|

07-03-2014, 02:39 PM

07-03-2014, 02:39 PM

|

#72

|

|

Full time employment: Posting here.

Join Date: Dec 2013

Location: San Diego

Posts: 880

|

Quote: Quote:

Originally Posted by Meadbh

|

After a market goes up for a while certain things happen related to the rise, such as those "signs" in the article. They are measures of the past not the future.

Years ago I regressed a number of "indicators" I don't remember all of them, things like put/call ratio, and other "sentiment" measures against the past and future changes in the market. As you might expect all of these measures were correlated to past market changes (decreasing with time before present), the future correlation was zero.

All of changes in these measures

1. Is there a surge in individual investor participation in the markets?

2. Is there a significant increase in the use of margin debt?

3. Do we witness a sharp rise in IPOs and merger activity?

4. Do the stock prices of low-quality companies reach new highs?

5. Is the media bullish?

6. Is the Fed providing or withdrawing liquidity from the markets?

7. Are interest rates expected to decline or rise?

8. Are profit margins at a cyclical bottom or peak?

9. Are valuations extreme?

10. What does CAPE signal about the future?

can be explained by what has happened to the market in the past. None of them say anything about the future. As markets go up people get increasingly optimistic, as they fall the get increasingly pessimistic.

It is natural to think that somehow this rise in optimism or pessimism can foretell something about the future, but it doesn't (we would all be rich if it did, or maybe none of us would be, because we would all be doing the same timing thing, ergo no salami). The changes in these measures can be completely explained by what has happened in the past.

I have often thought I should re-run that experiment, but after I did it, it seemed so obvious, and I am basically lazy.

__________________

Merrily, merrily, merrily, merrily,

Life is but a dream.

|

|

|

07-03-2014, 03:47 PM

07-03-2014, 03:47 PM

|

#73

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by CaliforniaMan

...

I have often thought I should re-run that experiment, but after I did it, it seemed so obvious, and I am basically lazy.

|

Good points but maybe I'm biased being from California?

So often I find that the article writer is the lazy one. They do not present a multi-decade set of data to show how good a predictor their model is. But that would be real hard work and those writers have deadlines to meet, more articles to write, etc.

|

|

|

07-03-2014, 04:07 PM

07-03-2014, 04:07 PM

|

#74

|

|

Recycles dryer sheets

Join Date: Jan 2014

Posts: 277

|

Quote: Quote:

Originally Posted by CaliforniaMan

After a market goes up for a while certain things happen related to the rise, such as those "signs" in the article. They are measures of the past not the future.

Years ago I regressed a number of "indicators" I don't remember all of them, things like put/call ratio, and other "sentiment" measures against the past and future changes in the market. As you might expect all of these measures were correlated to past market changes (decreasing with time before present), the future correlation was zero.

All of changes in these measures

1. Is there a surge in individual investor participation in the markets?

2. Is there a significant increase in the use of margin debt?

3. Do we witness a sharp rise in IPOs and merger activity?

4. Do the stock prices of low-quality companies reach new highs?

5. Is the media bullish?

6. Is the Fed providing or withdrawing liquidity from the markets?

7. Are interest rates expected to decline or rise?

8. Are profit margins at a cyclical bottom or peak?

9. Are valuations extreme?

10. What does CAPE signal about the future?

can be explained by what has happened to the market in the past. None of them say anything about the future. As markets go up people get increasingly optimistic, as they fall the get increasingly pessimistic.

It is natural to think that somehow this rise in optimism or pessimism can foretell something about the future, but it doesn't (we would all be rich if it did, or maybe none of us would be, because we would all be doing the same timing thing, ergo no salami). The changes in these measures can be completely explained by what has happened in the past.

I have often thought I should re-run that experiment, but after I did it, it seemed so obvious, and I am basically lazy.

|

Very intriguing and insightful to me. I have also "felt" this is the reality. Nice to have your empirical analysis, even as a single data point.

I always find it fun to confuse my colleagues when there is inside company info discussed and then someone states the obvious caution, "don't trade the company stock." With a straight face I ask, "so should I buy long or short the stock?"

Like stocks really move on singular correlation. LOL

It amazes me how many very smart people are completely clueless about investing and the market.

Sent from my iPad using Early Retirement Forum

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|