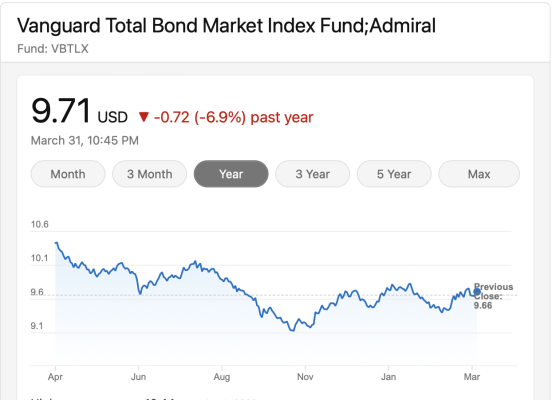

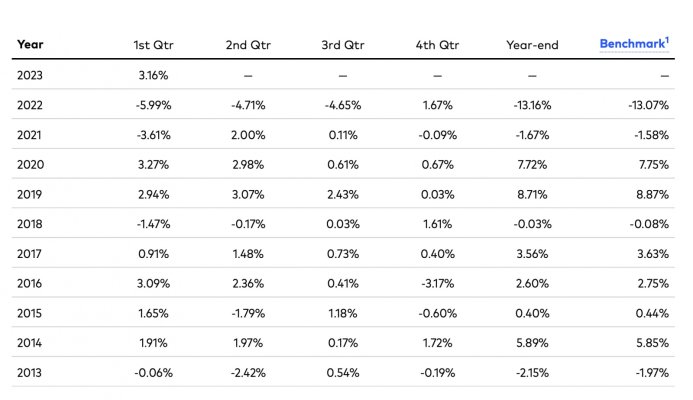

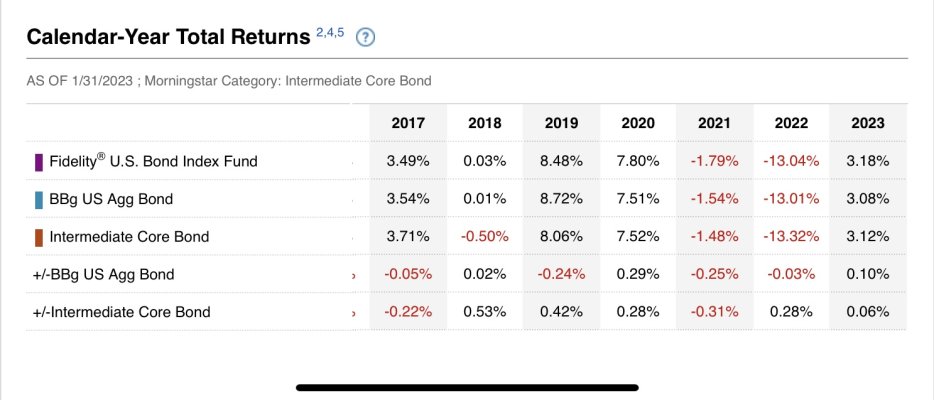

As long as the yield curve remains inverted, bond funds will perform poorly. Look at distributions paid by short to long term bond funds versus cash. The distribution yields are still pathetic relative to cash in a money market fund. Even the shortest duration bond funds have not been able to increase their distributions to keep pace with short term CDs, treasury bills, and money market funds or even FDIC insured savings account deposits at banks. If many banks are sitting on losses due to investments in coupon debt, why would anyone buy a fund bloated with similar debt or worse? A bank can hold the debt to maturity and recover face value of the bank, but the bond fund will sell that debt at a loss when there is a liquidity issue due to redemptions. This is not too different from the SVB faced when it sold bonds at a 10% loss to meet liquidity requirements.