REWahoo

Give me a museum and I'll fill it. (Picasso) Give

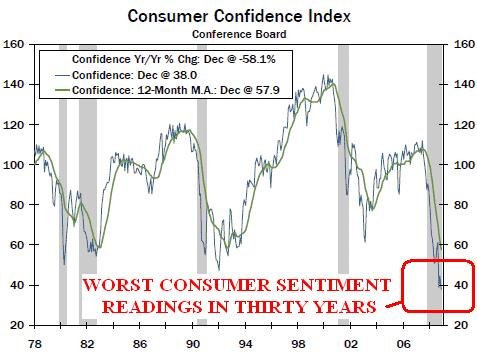

This report indicates we may have already experienced the worst of the recession and although the economy may not be improving, it may be getting worse at a decreasing rate.

Prosperity may not be just around the corner, but statistical evidence is mounting to suggest that the worst of this recession may soon be past.

Signs of Life

Prosperity may not be just around the corner, but statistical evidence is mounting to suggest that the worst of this recession may soon be past.

Signs of Life