UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

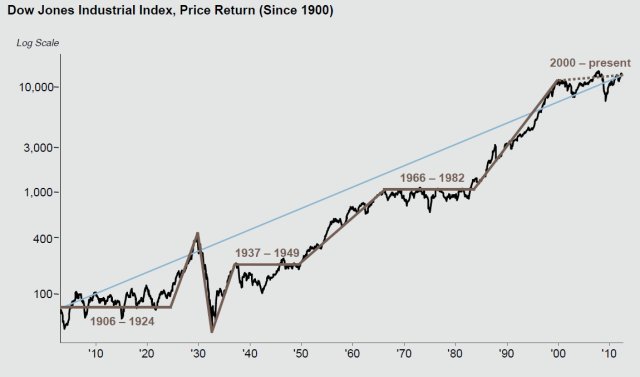

I ask because it does seem during bull markets it is NEVER crystal clear that we are in a bull market. There is always things to worry about. Inflation, deflation , interest rate rise, recession,etc. I understand why investors might be scared to invest. I am not referring to forum members. However, there will never be a time when it is obvious that things are going to be good in the markets. If it is, then I will be very scared. We will probraly be overbought at that point. IMO, we are not there yet, nor do I really care one way or the other. I just find it interesting how things work. Thoughts?

Last edited: