yakers

Thinks s/he gets paid by the post

Saw this on the Boglehead site and have been reading it, pretty wide ranging engagement with retirement planning and outcomes.

https://am.jpmorgan.com/content/dam...etirement-insights/guide-to-retirement-us.pdf

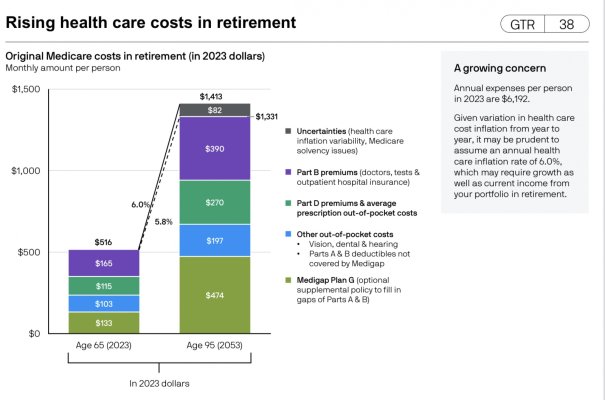

It even had a page on why people reported that they had reitred early with 32% for medical reasons and 38% because they could afford it. Also liked the dollar cost raviging term for periodic retirement withdrawals

https://am.jpmorgan.com/content/dam...etirement-insights/guide-to-retirement-us.pdf

It even had a page on why people reported that they had reitred early with 32% for medical reasons and 38% because they could afford it. Also liked the dollar cost raviging term for periodic retirement withdrawals