Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,287

I have been looking at my return based on Vangurd's chart of returns...

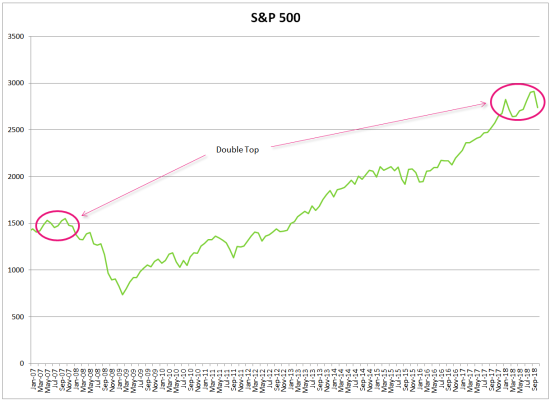

I was hoping that my 10 year return was going to jump next month as Oct 2008 was about to drop off... BUT, right now it looks like I am going to lose almost as much this month as I did 10 year ago!!! And we still have more than a week to go....

Now, the pct is much less, but in absolute $$$s it is almost the same...

I was hoping that my 10 year return was going to jump next month as Oct 2008 was about to drop off... BUT, right now it looks like I am going to lose almost as much this month as I did 10 year ago!!! And we still have more than a week to go....

Now, the pct is much less, but in absolute $$$s it is almost the same...