walkinwood

Thinks s/he gets paid by the post

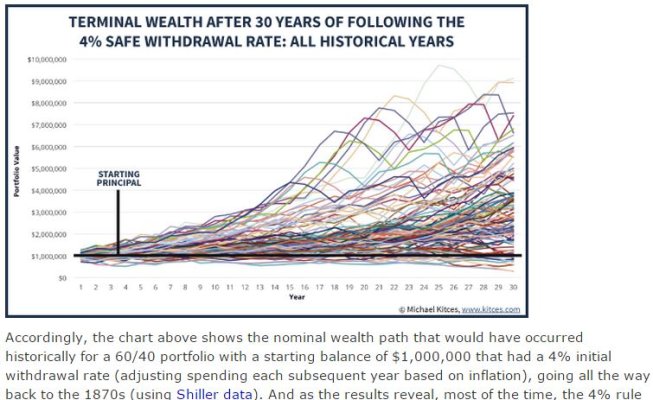

Michael Kitces has written another balanced article.

He observes that the current state of 2000 and 2008 retirees portfolios is comparable to that of 1929, 1937 and 1966 retirees. Better in some respects.

https://www.kitces.com/blog/how-has...bble-and-the-2008-financial-crisis/#more-7856

Be sure to read the last section on historical perspective.

This one observation struck me and I'll incorporate this calculation in my annual analysis of our situation

He observes that the current state of 2000 and 2008 retirees portfolios is comparable to that of 1929, 1937 and 1966 retirees. Better in some respects.

https://www.kitces.com/blog/how-has...bble-and-the-2008-financial-crisis/#more-7856

Be sure to read the last section on historical perspective.

This one observation struck me and I'll incorporate this calculation in my annual analysis of our situation

Still, the current 6.2% withdrawal rate of that year-2000 retiree today is actually modest enough that a retiree couple in such a scenario could simply take the remainder of their portfolio, and buy a joint and survivor single premium immediate annuity with inflation-adjusting payments. At current market rates, the inflation-adjusting payout for the 80-year-old couple (assuming the 65-year-old retirees are now 15 years into retirement) would be 6.5% for their joint lives, more than enough to cover their 6.2% spending rate.

.

.