USGrant1962

Thinks s/he gets paid by the post

My very last individual stock is Lowes, which I bought 20 years ago at an average price of $7.85 per share, so my position is 90% capital gains and 10% principal  . 2018 will be my first full year of ER, and will be my first draw on my portfolio, so I'm trying to decide the best tax-efficient withdrawal strategy from my taxable accounts. I think selling Lowes is it - it alone will essentially fund my year's spending requirements.

. 2018 will be my first full year of ER, and will be my first draw on my portfolio, so I'm trying to decide the best tax-efficient withdrawal strategy from my taxable accounts. I think selling Lowes is it - it alone will essentially fund my year's spending requirements.

My taxable accounts look like:

11% Lowes with 90% CGs

54% Large Cap Vanguard MFs with 50% CGs (PRIMECAP and Tax Managed Cap Appreciation)

21% Tilt Vanguard MFs with ~17% CGs (Emerging Markets and Small Value)

14% I-bonds (emergency fund)

Other background and considerations:

My question is, am I missing anything that should impact this decision?

My taxable accounts look like:

11% Lowes with 90% CGs

54% Large Cap Vanguard MFs with 50% CGs (PRIMECAP and Tax Managed Cap Appreciation)

21% Tilt Vanguard MFs with ~17% CGs (Emerging Markets and Small Value)

14% I-bonds (emergency fund)

Other background and considerations:

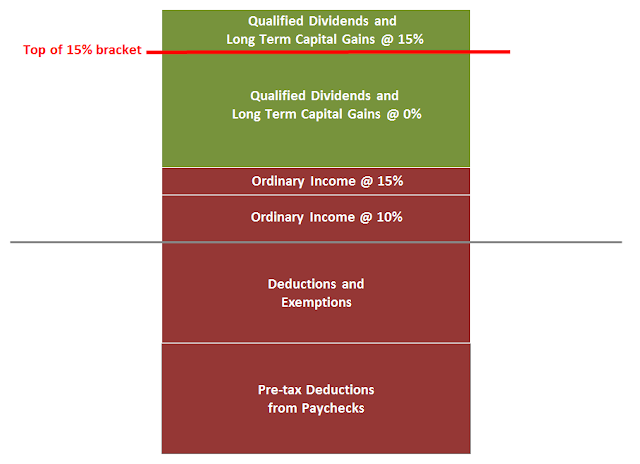

- Short to medium term I intend to sell off the large cap MFs, taking advantage of the 50% return of principal to lower AGI/MAGI to qualify for ACA subsidies and headspace for Roth conversions.

- But, for 2018 I'm staying on COBRA, it is a better plan and cheaper than unsubsidized ACA, so I have a window for a high MAGI next year.

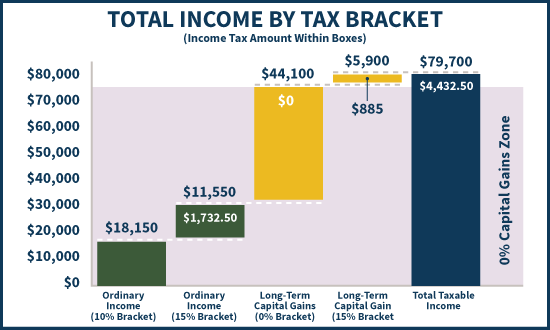

- I plan to sell early next year, hopefully most all of it will be in the 0% CG bracket, if I sell this year it will all be in the 15% bracket (and may cause some other unpleasant tax phase-outs).

- I don't have any losing positions in my taxable accounts, so no offsetting capital losses (used those up last year).

- I might get some consulting work next year that could push some of the CGs to 15% bracket (and also affect ACA subsidies), but I can't complain too much about more money.

- My AA is 55/45, and I'm planning age-in-equities from there (that's a whole 'nother discussion). About 75% of my portfolio is in tax advantaged accounts, so I can rebalance there as needed to offset taxable stock sales.

My question is, am I missing anything that should impact this decision?