Bryan Barnfellow

Thinks s/he gets paid by the post

My wife and I are currently FIRE'd and loving our life in Switzerland in terms of quality of life, natural and cultural environment, political and social tranquility, and easy travel to all the places we want to visit regularly.

However, about 80% of our income derives from investments in the US (and soon SS payments as well); so all are denominated in US dollars. I move funds quarterly to our Swiss bank account to pay our living expenses here and have to deal with the USD/Swiss Franc exhange pair. I have found the best strategy for this, so it is working fine now.

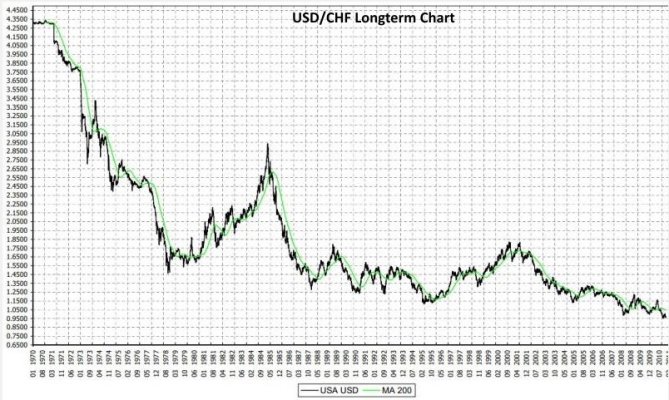

While the dollar has strengthened relative to the Franc in the past year, the overall trend in the pair has been decidedly against the dollar. It is trading today at 1.02 USD to 1.0 CHF. Long term economic projections seem to indicate a return in the next 10 years to the gradual decline of the USD. This, of course, sucks for us. The Swiss franc is a go to currency when there is fear in the world economy. Note: the USD in 1970 bought about 4.38 CHF. Today it buys 0.98 CHF.

So, for other expats or ER folks who are living abroad, especially those in it for the long term, how are you dealing with potential USD long term weakness against your own currency (if applicable)? Currency hedging is one option of course. Selling the US-based assets, where possible, and reinvesting in Swiss financial assets is another for me; but, leaving aside the conversion costs, including significant capital gains taxes, the expenses here remain high for investors and a significant portion of dividends are held back until they are claimed on the annual Swiss tax return.

I'm not feeling a rush to act right now; but would like to have a clear plan going forward -- it's a bit like the frog boiling slowly in a pot of water analogy. Your thoughts very much welcome! Thanks

-BB

However, about 80% of our income derives from investments in the US (and soon SS payments as well); so all are denominated in US dollars. I move funds quarterly to our Swiss bank account to pay our living expenses here and have to deal with the USD/Swiss Franc exhange pair. I have found the best strategy for this, so it is working fine now.

While the dollar has strengthened relative to the Franc in the past year, the overall trend in the pair has been decidedly against the dollar. It is trading today at 1.02 USD to 1.0 CHF. Long term economic projections seem to indicate a return in the next 10 years to the gradual decline of the USD. This, of course, sucks for us. The Swiss franc is a go to currency when there is fear in the world economy. Note: the USD in 1970 bought about 4.38 CHF. Today it buys 0.98 CHF.

So, for other expats or ER folks who are living abroad, especially those in it for the long term, how are you dealing with potential USD long term weakness against your own currency (if applicable)? Currency hedging is one option of course. Selling the US-based assets, where possible, and reinvesting in Swiss financial assets is another for me; but, leaving aside the conversion costs, including significant capital gains taxes, the expenses here remain high for investors and a significant portion of dividends are held back until they are claimed on the annual Swiss tax return.

I'm not feeling a rush to act right now; but would like to have a clear plan going forward -- it's a bit like the frog boiling slowly in a pot of water analogy. Your thoughts very much welcome! Thanks

-BB

Last edited: