Delawaredave

Recycles dryer sheets

- Joined

- Apr 9, 2005

- Messages

- 184

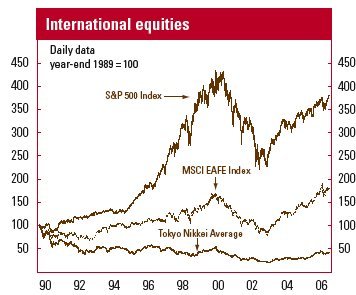

Every time I get Vanguard newsletter, I ponder about the chart comparing 16 years of S&P vs. EAFE (posted below, if I can, otherwise here is link)

Moderator edit: Shorter link to shrink the post margins.

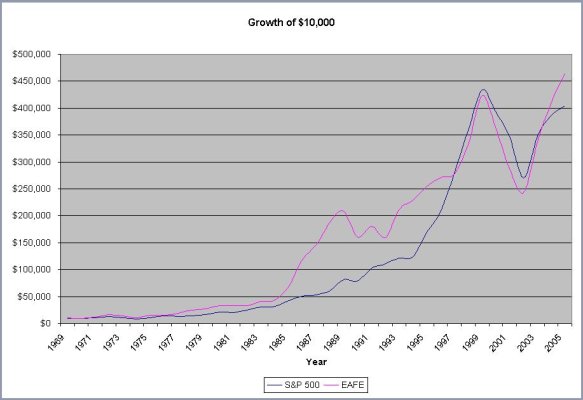

I thought over long, long term, S&P and EAFE grew about the same.

If that's true, looks like there's a huge divergence between S&P and EAFE over last 15-16 years.

What happens over next 15 years ?

1. Will they both regress-to-mean and 15 years from now be around same point ?

2. Will the world economy grow even faster than US and have EAFE eclipse S&P ?

3. Will the US continue to kick butt against world economies and get even further ahead ?

Moderator edit: Shorter link to shrink the post margins.

I thought over long, long term, S&P and EAFE grew about the same.

If that's true, looks like there's a huge divergence between S&P and EAFE over last 15-16 years.

What happens over next 15 years ?

1. Will they both regress-to-mean and 15 years from now be around same point ?

2. Will the world economy grow even faster than US and have EAFE eclipse S&P ?

3. Will the US continue to kick butt against world economies and get even further ahead ?