Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Though it looks old, this was published in Jan 2023.

https://taxfoundation.org/publications/latest-federal-income-tax-data/* In 2020, taxpayers filed 157.5 million tax returns, reported earning nearly $12.5 trillion in adjusted gross income (AGI), and paid $1.7 trillion in individual income taxes.

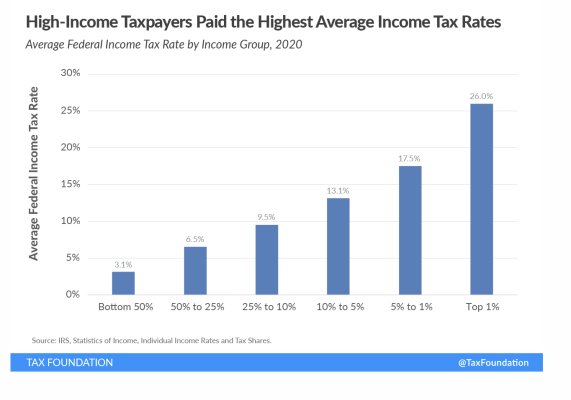

* The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

* The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent.

* The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

* The 2020 figures include pandemic-related tax items such as the non-refundable part of the first two rounds of Recovery Rebates and the $10,200 unemployment compensation exclusion.