What do y'all think about the merits of LTC insurance? I bought a policy in my late 40s. That is much earlier than most people buy LTC, and maybe it was a mistake. But LTC insurance is (strictly) medically underwritten, so my thinking at the time was to get this in place before my wife or I had a medical condition that precluded it. And of course the monthly premiums are lower when you buy the policy younger.

The group policy I bought was relatively low cost, as these things go, and was an "indemnity" type policy, which I think is somewhat unusual. In other words, once the insured meets the standard coverage requirement that apply to all tax qualified LTC policies (the insured requires substantially assistance with two or more ADLs, or meets the cognitive impairment standard), the benefit is paid automatically. There is no requirement to be in a facility or even to be receiving care from a licensed provider. You just show that you meet the coverage standard, and you get the monthly payment.

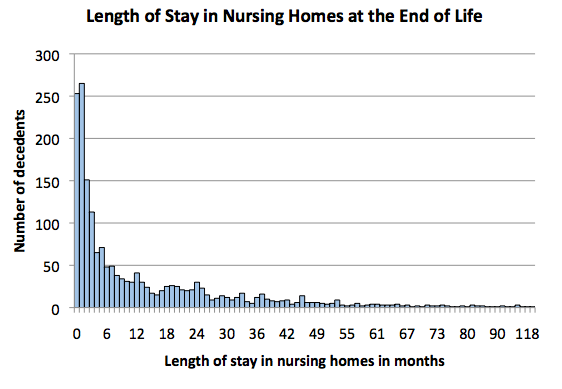

I could have bought lifetime coverage, but it was significantly more expensive and most people are not "on benefit" for more than a few years. So I bought a 6 year benefit.

I also could have bought an option to pay premiums only until age 65, at which time the policy becomes fully paid up, but I did not do that. So I pay premiums until I am on benefit. I may have made a mistake by not buying this option. At the time, I did not want to pay the substantially greater premium, and the "break even" point was pretty old, especially when one considers the time value of money. But I neglected to take into account the prospect of premium increases between age 65 and whenever I go on benefit. Anyway, that is the decision I made and it is not changeable.

The biggest problem I have with these policies is the prospect of premium increases. The insurance companies did a lousy job, early on, of underwriting these policies, and they can apply to the state regulators for premium increases. Many states have approved enormous increases. My state has approved more limited increases, but the future is young, as they say.

When I asked someone knowledgeable about these policies, he said he generally recommends against them, believing they are too restrictive and there's too much risk around premium increases -- so better to self insure -- but that the policy I was being offered was quite cheap and had the best terms he had seen in the market, so it would be reasonable to buy it. And that is what I did.

Just wondering what other people here think about these policies.

The group policy I bought was relatively low cost, as these things go, and was an "indemnity" type policy, which I think is somewhat unusual. In other words, once the insured meets the standard coverage requirement that apply to all tax qualified LTC policies (the insured requires substantially assistance with two or more ADLs, or meets the cognitive impairment standard), the benefit is paid automatically. There is no requirement to be in a facility or even to be receiving care from a licensed provider. You just show that you meet the coverage standard, and you get the monthly payment.

I could have bought lifetime coverage, but it was significantly more expensive and most people are not "on benefit" for more than a few years. So I bought a 6 year benefit.

I also could have bought an option to pay premiums only until age 65, at which time the policy becomes fully paid up, but I did not do that. So I pay premiums until I am on benefit. I may have made a mistake by not buying this option. At the time, I did not want to pay the substantially greater premium, and the "break even" point was pretty old, especially when one considers the time value of money. But I neglected to take into account the prospect of premium increases between age 65 and whenever I go on benefit. Anyway, that is the decision I made and it is not changeable.

The biggest problem I have with these policies is the prospect of premium increases. The insurance companies did a lousy job, early on, of underwriting these policies, and they can apply to the state regulators for premium increases. Many states have approved enormous increases. My state has approved more limited increases, but the future is young, as they say.

When I asked someone knowledgeable about these policies, he said he generally recommends against them, believing they are too restrictive and there's too much risk around premium increases -- so better to self insure -- but that the policy I was being offered was quite cheap and had the best terms he had seen in the market, so it would be reasonable to buy it. And that is what I did.

Just wondering what other people here think about these policies.