How to Protect yourself?

A Familar Word in investing> Diversify..

not more than 10-15% into any One Investement

stick with the big boys/ Fund Families

Speculate with max 5%

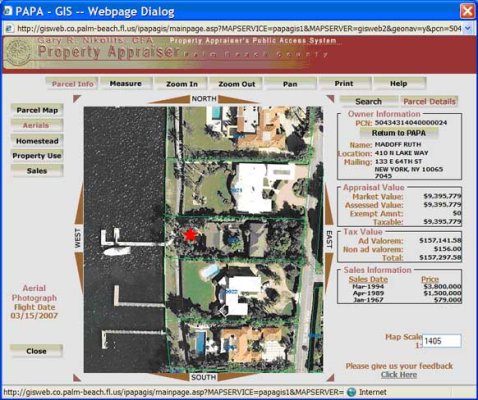

Cases Like Murdoffs are rare.. and predictiable..

It was basically Other Rich peoples Free $..

Would you feel bad if It Was Jerry Seinfelds $ and he Has lost $10 Million out of his $300 Million Portfolio?

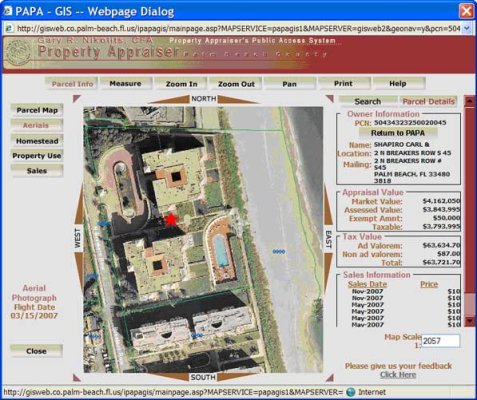

It was also a Network of a Religous Sect so to speak.. A Group of Jewish wealthy people that were basically "Required" or Obligated to join to become Successfull within it's Own kind and to support otehrs of their own kind...Much like when Italians , Irish, Polsih & German immigrants lived among themselves and stuck together .. Notice How many Irish Cops there were in the Old Days, same for Firemen , and the Plumbers, Streets and Sans controlled by the Italians..Like the "Free Masons" or other organizations, Where there is Money, there are bad apples in everygroup...Some more than others..

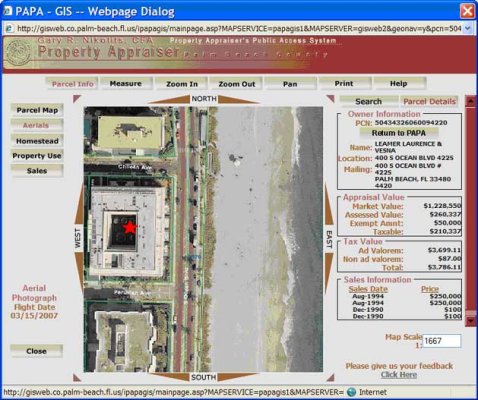

Mort Zukerman's story, although blown out of proportion, he More or less Had to Put a Few Dollars ( 10%) of his Wealth into it.. He made more On his Own investments..He didn't loose 30 or 50% of his personal Wealth either, it was from his Charitible trust account..although he advocates Not wanting to be "In the Market" and is Negative about it, Stands to reason, He made and still makes Most of his $ From where? RealEstate and Publishing business...Like asking Donald Trump does he invest his Money in Index Funds...LOL

Much like Having to Join any Society to get Up the Ladder.. a Club if you will..and Ck out those Charities and what their purpose is for? Where do they send their Money too? Ans> Isreal..and other Jewish related programs .. .. all very Good and Upstanding of course..

And they made 10% apy? They got their $ back in 7 yrs... others just were just foolish in Putting all their Eggs in one basket. and just another reminder and Lesson learned by others not to do that..

and maybe just bring the subject up with your Parents and Other Older Relatives as well.. ' Max 10% in anything outside That isn't FDIC Insured Pop or Aunt Peggy" I have a vested Interest in your $ that will be Mine you know! LOL.. I used to say that all the time to them..and it worked.. They mostly Owned nothing but CD's and Treasuries their Last 5-10 yrs ..and kept the Insurance -Annuity And Chatholic Charites sales people out of their Checkbooks too...LOL

To a Lessor degree, It's also why I own several Balanced Funds and not just 1, no matter how good it is..( Like some DODBX people found out the hard way too I know)

Happy Chanukah

and Happy Holidays !